In Case You Missed It: Automotive Aftermarket Industry News You Need to Catch Up On

Since you can’t hit your target with your eyes closed, we’re here to help automotive eCommerce businesses stay on top of the latest auto aftermarket news and trends. While the insights from your business analytics are crucial, you also need a reliable source to steer your auto parts eCommerce journey in the right direction.

Every month, we round up the most important auto parts eCommerce updates, automotive news, aftermarket trends and industry research to keep online businesses in the loop. Plus, we share the latest from SEMA, AASA, MEMA, Custom Automotive Network and the Auto Care Association.

Learn what shapes the future of automotive eCommerce from a single digest packed with articles, case studies, and auto parts market research.

Today, we are watching the automotive market evolve at breakneck speed. Digital innovation, data accuracy, automation, and rising customer expectations for parts compatibility and fast delivery times are shaping the future of automotive retail yet posing new challenges to auto parts sellers.

But, with that, new growth opportunities pop up, provided that you spot the changes in the market promptly and adjust your business accordingly!

That said, we’ve analyzed what we’ve seen in the past years, including 2023 and 2024, and compiled the hottest auto parts news and predictions for 2025 to navigate you in this highly dynamic landscape.

April 2025’s Top Automotive Updates

👉 Tariffs Are Impacting the Automotive Aftermarket

New US tariffs may affect up to 45% of light-duty vehicle sales in the US, with nearly a quarter (23%) of those being imports from outside North America.

The automotive aftermarket is divided on the potential impact. Some industry voices believe the tariffs could drive positive change, while others warn of significant challenges ahead.

“The expansion of these tariffs will have far-reaching consequences,” says Bill Hanvey, Auto Care Association President and CEO.

The concern stems from the industry’s reliance on global raw materials. Many critical vehicle components require specialty steels that simply aren’t produced domestically in sufficient quantities. This dependence on international supply chains already puts US manufacturers at a disadvantage – and new tariffs could make competing both at home and abroad even tougher.

Why it matters: When parts production gets more expensive and complicated, everyone feels it – from repair shops to consumers keeping their vehicles on the road.

Source: Aftermarket Matters

👉 Amazon’s Hold on Millennials Shopping for Auto Parts

The impact of Millennials on the automotive aftermarket is becoming increasingly clear, particularly with Amazon’s growing influence in this sector. As the largest generation in the U.S., Millennials are set to drive the bulk of light vehicle parts and repair volume throughout the decade.

Millennials value competitive pricing and peer reviews over traditional brand loyalty. They are already major contributors to the DIY market and are increasingly impacting the Do-It-For-Me (DIFM) sector.

Amazon’s success in the aftermarket industry is not just about tapping into the DIY market but also about leveraging its strong relationship with Millennials to secure a foothold in the future of mobility. Loyalty to Amazon, ranked as the most relevant brand in the U.S., has positioned the eCommerce giant as a dominant player in automotive parts and services. This shift underscores the growing importance of eCommerce platforms in transforming the automotive parts and repair landscape.

💡 Expert tip: Expand your sales channels by listing on Amazon – tap into a massive pool of car enthusiasts. Be where the buyers are.

Source: Auto Service World

March 2025 Automotive Highlights

The latest report from Dave Cantin Group highlights several key trends and aftermarket news that could impact the demand for parts and accessories in the near future.

👉 Rising Interest in Sedans

While SUVs and trucks have long been the top choice, there’s a noticeable 3-point increase in consumer interest in sedans compared to last year. With rising vehicle prices and economic uncertainty (an 8% increase year-over-year), many buyers may see sedans as a more affordable option.

👉 Korean Brands Gaining Ground

Brands like Hyundai and Kia are steadily gaining popularity, often at the expense of domestic names like Ford and Chevrolet. If this trend continues, aftermarket suppliers will need to adapt their inventory and fitment data to tap into this growing market.

👉 Declining Interest in Trucks and Crossovers?

Although SUVs remain dominant, interest in trucks and crossovers appears to be waning. This could impact everything from original equipment production to the aftermarket demand for accessories like lift kits and performance upgrades.

What This Means for the Aftermarket:

- Expect an uptick in demand for sedan parts and accessories.

- Adjust inventory and fitment data to reflect the rise of Korean brands.

- Be prepared for potentially softer truck accessory sales and adjust accordingly

While larger vehicles may still lead the long-term trends, these shifts are important to monitor. The most successful aftermarket businesses will stay ahead of consumer demand and continuously adapt their offerings.

Source: Dave Cantin Group

2025 Automotive Outlook: Change and Opportunity

“May we live in interesting times” – that saying perfectly sums up 2025. It’s a year full of both challenges and chances to grow. To succeed, businesses need to stay flexible and adapt quickly.

👉 Market Keeps Growing

The auto aftermarket isn’t slowing down. Online parts sales are rising fast (9% yearly) as buyers want convenience and deals. Specialty gear sales could hit $52.3 billion, thanks to strong jobs and wages – even with inflation worries.

👉 Global Parts Manufacturing Boom

The industry is expanding at 6.1% yearly, on pace to hit $1.19 trillion by 2032. More older cars on the road, steady car demand, and the hybrid market are fueling growth – especially for niche parts makers.

👉 Aging Vehicle Park

Inflation and tariff changes are increasing product costs, adding strain to the supply chain. Meanwhile, the high prices of new vehicles and ongoing high-interest rates are keeping used car values strong, creating more opportunities for maintenance and repairs on older vehicles.

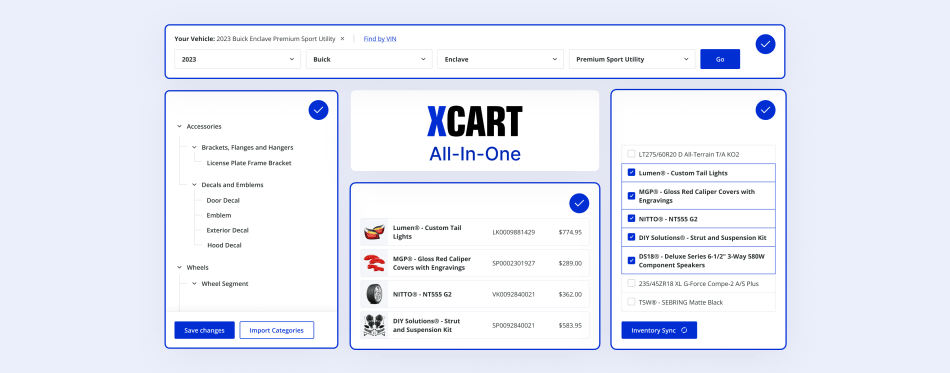

👉 Automation and Partnerships

Strong ties with catalog providers and parts suppliers keep your operations running smoothly. Integrated eCommerce systems ensure instant access to product updates – a must in the fast-moving aftermarket world, where real-time data means faster sales and fewer hiccups.

When automation, standardized processes, and centralized management work hand-in-hand with supplier collaboration, you get a nimble, efficient system built for adaptability.

👉 Top-Selling Parts: Trucks Still Rule

Light trucks dominate aftermarket sales: Pickups (32%), CUVs (15%), and SUVs (12%) lead the pack. EVs are gaining attention but face roadblocks like charging gaps and high costs, which is enough to make some owners rethink going electric.

👉 Consumer Demands Keep Elevating

Consumer preferences continue reshaping the market. Online shopping for DIY automotive parts is becoming the norm as customers seek convenience, transparent pricing, and fast delivery. Retailers with strong eCommerce platforms and personalized shopping experiences are standing out.

Bottom Line

In the evolving digital landscape of the automotive aftermarket, 2025 will favor those who stay ahead of the trends and technology. We’ll be sharing more news and updates to help you stay informed. Our team is constantly monitoring shifts in consumer behavior and emerging seller trends in the industry, which is why we have an ambitious roadmap of new features and integrations. Along with that, we’ll keep you updated on the latest X-Cart news, product releases, and trends that align with the changing market.

Stay Ahead with the eCommerce Platform Set Up for Growth – Just Like You

About the author