How to Prevent Chargebacks on Your Online Store: 9 Practical Tips to Limit Buyer Disputes

As an online seller, you know about the advantages and challenges of accepting digital payments all too well. Online payment processing allows for an expanded audience reach, flexible checkout options, and an optimized customer journey. But, with that, it also incurs some risks related to buyer disputes.

As long as your number of chargebacks is low, you may view them as an occasional annoyance. However, with eCommerce fraud on the upswing, chargebacks can be quite an issue for an online entrepreneur spelling significant financial losses. This is why limiting the number of chargebacks you receive should be your top priority.

This article covers the best practices that merchants should apply to reduce chargebacks on their online stores. But before we dive into the main strategies to enhance your eCommerce chargeback management system, let’s break down what a chargeback is and how a dispute process works for an online merchant.

Let us fill you in one step at a time.

What Is a Chargeback?

A chargeback is a forced transaction reversal initiated by an issuing bank at a cardholder’s request. Also referred to as a payment dispute, it shares some similarities with a refund. However, these two concepts are not interchangeable.

A Refund vs. a Chargeback

With a refund, shoppers get their money back directly from sellers and are supposed to return a purchased item.

That’s not the case with a buyer dispute, where a customer bypasses a merchant to turn to their bank or credit card company for a charge reversal. Unlike refunds, chargebacks cost merchants much more than just the value of the purchase. Also, sellers suffer costly bank fees, payment processing expenses, operating and marketing costs, and the time and effort spent to fight a buyer dispute.

If a customer is unsatisfied with a purchase, issuing a refund is always the best way to retain trusted relationships with your customer and avoid costly chargeback-related bank fees.

As a consumer-protection mechanism against billing errors and fraudulent transactions, a chargeback gives customers security and peace of mind while shopping online. But for eCommerce businesses, multiple payment disputes pose severe risks to the overall online store performance.

How Much of a Threat Are Chargebacks to Merchants?

Some merchants compare chargebacks to sharks in clear waters. And just like a shark bites, the cost of chargebacks can take you out without warning. With no intention to scare you, we’ll give you a complete picture of sale reversal aftereffects and explain why they can be an existential threat to your eCommerce business.

1. Significant Financial Losses

According to ChargebackGurus, each buyer-disputed transaction can cost merchants over $200 for every $100 purchase. The revenue loss includes the value of merchandise, ancillary non-refundable expenses, plus hefty chargeback fees that vary between $20 and $100, depending on the merchant’s acquirer.

| Transaction value | $100 |

| Transaction fee (4%) | $4 |

| Product acquisition costs (23%) | $23 |

| Marketing and advertising costs (35%) | $35 |

| Operational costs (including fulfillment, storage, and logistics) (20%) | $20 |

| Chargeback fee ($25) | $25 |

| Total: | $207 |

With a sale reversal, all those related expenses are no longer “a cost of doing business”, but instead become revenue leakage that can sink your business.

2. Elevated Chargeback Rate

A chargeback rate (aka chargeback ratio) is the metric that compares a seller’s total sales against the number of customer disputes the business faced during a given period. If your eCommerce store has a high chargeback ratio that exceeds your card network’s threshold, the payment processor can label your business as risky.

The consequences of having a “high-risk” merchant account include higher transaction rates, limits to monthly processing volume, and a hold of reserve funds. To make matters worse, banks can terminate the account entirely leaving the merchant no choice but create a new legal entity and restart their business.

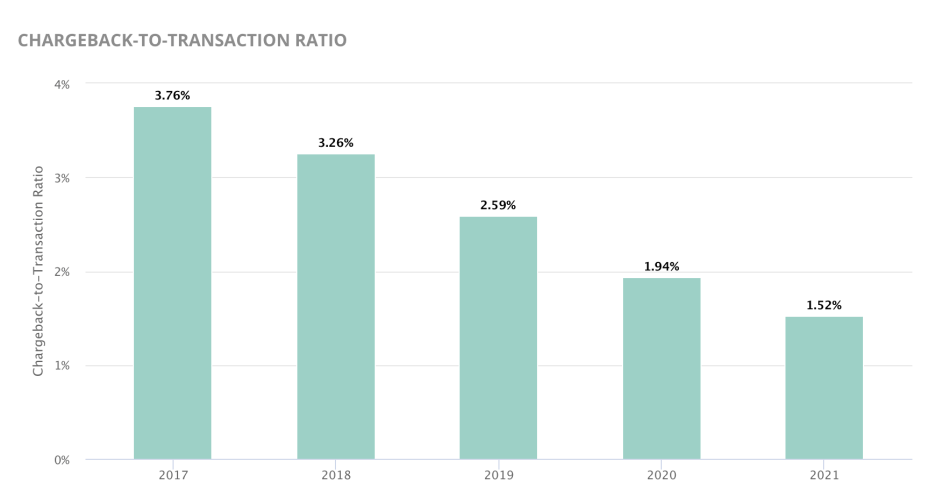

The good news is that the overall chargeback-to-transaction ratio currently shows a year-over-year decrease. However, as of 2021, the average chargeback-to-transaction ratio was 1.52 %, which is still above most card networks’ threshold of 1%.

3. Reputational Damage

Along with the harmed relationships with financial partners, chargebacks can seriously hurt customer loyalty. The public eventually finds out if a merchant has a chargeback problem through word of mouth or review forums. And if you have a high volume of chargebacks, shoppers will think twice before making a purchase. And if you don’t want to take my word for it, Qualtrics has pinned down some review statistics showing that 94% of respondents admitted an online review had convinced them to avoid a business.

In sum: From all this, it follows that the risks for eCommerce businesses are high, and to avoid severe ramifications, merchants should keep their chargeback rates in check, diligently limiting the number of buyer disputes.

Most Common Chargeback Reasons

A clear understanding of the common reasons behind filing a chargeback helps sellers understand how to spot and eliminate their vulnerabilities, consistently reducing the number of sales reversals.

Here are some insights into the most common chargeback causes:

Third-Party Fraud

The chargeback occurs when customers discover an unauthorized or suspicious transaction on their account statement or a credit card bill and ask a card issuer to reverse the charge. The possible causes are a payment card physical theft or a cyber-attack when hackers steal customers’ credit card data or use their accounts to pay for purchases.

Merchant Error

Customers can also dispute a charge if they are unsatisfied with the product. In this case, the main reasons for a chargeback can be:

- Low-quality products

- Defective merchandise

- Non-deliveries

- Goods not as described

Friendly Fraud

Some shoppers deliberately dispute legitimate transactions despite sellers providing their products or services as requested. Friendly fraud chargebacks are one of the primary sore spots for online sellers, accounting for between 40% and 80% of all eCommerce fraud losses.

Chargebacks’ Gray Area

- Canceled recurring transaction

With payments for subscription services, customers sometimes forget about the transaction. In such cases, they may request a chargeback, as they believe the products or services have been mis-sold to them.

- Accidental friendly fraud

Customers may initiate a chargeback mistaking the genuine transaction for a fraudulent one. For example, this may happen if they purchased an item from a branded eCommerce store, but the merchant descriptor names the parent company of that brand on the customer’s statement.

Other reasons for accidental friendly fraud can relate to a customer error or shipping blunders when customers are unaware that their purchases have been delivered successfully.

- Duplicate processing

The main reasons for a chargeback here can be human error, such as a customer duplicating the purchase inadvertently, or technical issues on behalf of the merchant.

The best way to uncover a dispute’s cause is to look into its chargeback reason code. Please note that card networks use different reason code formats.

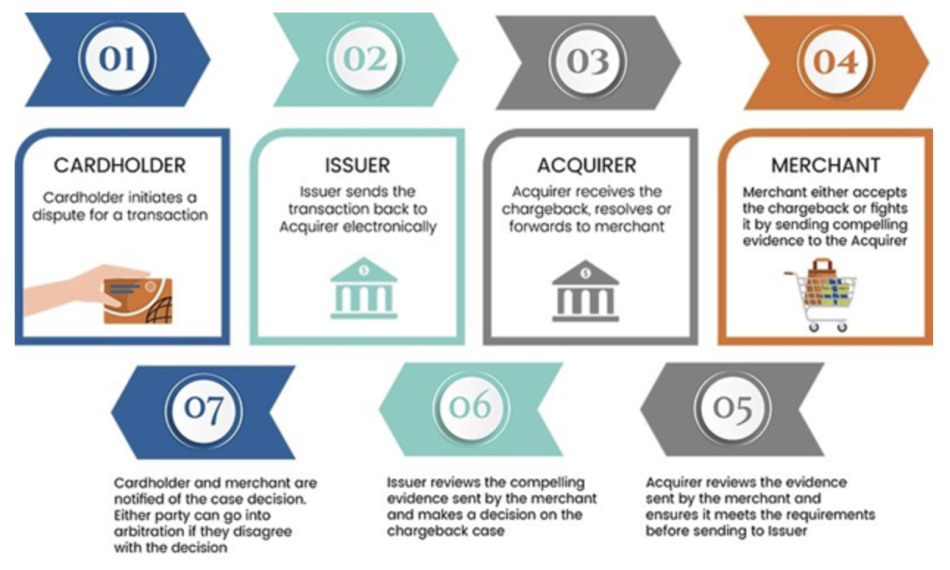

The Process of Disputing a Chargeback

After receiving a chargeback request, the merchant should decide whether to accept the claim or fight it through representment.

Disputing the chargeback involves submitting compelling evidence (usually within 5-10 days), including the following documents:

- Shipping receipts and tracking numbers

- Delivery notifications indicating the shipping date – the proof that the customer received the product or service they paid for

- Policies – a copy of the refund or return policy that the customer agreed to

- Records of correspondence with the customer about the transaction

- Evidence that the customer works or lives at the provided delivery address

- For digital services, customer IP address and download time

Once the merchant compiles and submits all the documents, the issuing bank reviews the evidence and decides whether to accept or reverse the chargeback.

At this point, there are three possible outcomes:

- The card issuer submits the chargeback as invalid and returns the charge to the merchant.

- The card issuer rejects the merchant’s representment, and the chargeback stands.

- The card issuer instigates a pre-arbitration case and requests more evidence from the merchant.

9 Best Practical Tips for Reducing Chargebacks

Underestimating the consequences of a chargeback can be devastating for the overall business performance. This is why preventing them is your top priority. Merchants should avoid chargebacks by resolving internal issues and implementing careful prevention practices.

1. Provide an Available Customer Service

By perfecting customer service, sellers can avoid chargebacks resulting from miscommunication. Managing consumer expectations and improving buyer-seller communication are the main steps to buyer loyalty.

Since customers always expect a timely response to their inquiries, monitoring your email and social channels to provide prompt replies is a must. Also, ensure your contact information, such as phone numbers and email addresses, is clearly visible to help customers reach out to you in case of any issue with their purchase.

2. Watch Your Product Descriptions

When a customer receives a product that doesn’t meet their expectations, they’ll likely contact you for a refund or even initiate a chargeback. Make sure your product descriptions are incentivizing but not over-promising. Accurate and straightforward information on your website will help you avoid misunderstanding the item’s appearance, capabilities, or components.

3. Keep Tabs on Your Transactions

Keeping records of all your transactions, shipping dates, tracking numbers, and all the information can help you win a potential dispute. So, retain the transactions between you and your buyer for a minimum of six months, particularly personal requests or requests to deviate from the standard procedure.

4. Rethink Your Return & Refund Policy

Keep chargebacks in mind when creating your refund and return policies. For example, if you have a policy of not accepting returns, you will likely receive many buyer dispute claims. On the contrary, by making your return policies clear and easy to follow, you’ll encourage customers to settle the issues with you instead of turning to the credit card issuer for a charge reversal.

Side note: X-Cart store owners can handle returns hassle-free. The Order Returns add-on shows the customer’s return claim in the order return queue and on the order details page. The customer will receive an appropriate email whether you approve or decline the request.

5. Deliver a Superior Shipping Experience

Partnering with a reliable shipping provider who can ensure adequate packaging and deliver products promptly is the backbone of a trusted eCommerce business. Also, ensure delivery times and shipping costs are clearly stated on invoices and order confirmations.

Pro Tip: Pay particular attention to shipping times and payments for international orders to indicate the business location, local currency, and export/shipping restrictions. If a customer’s local currency is not displayed, they may get confused about the amount they are paying and file a chargeback when the amount on their bill does not match.

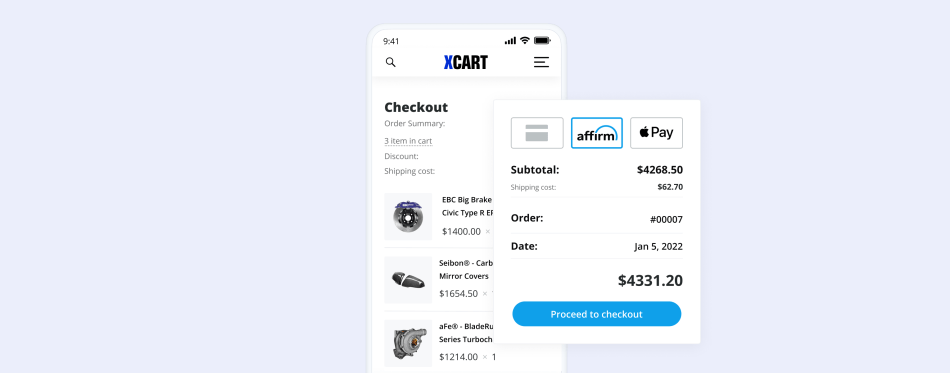

6. Choose Credible Payment Services

With secure, PCI-compliant payment services, such as PayPal, Stripe, or Authorize.Net (all available at X-Cart stores), to name a few, you can level up your fraud prevention strategy, ultimately limiting the number of fraudulent chargebacks on your online store.

Here is a quick bird’s-eye view of the popular payment solutions:

- PayPal uses the latest technologies to seamlessly streamline transactions and help secure card data by redirecting shoppers from your online store to the payment gateway site to enter credit card data.

- Stripe can assign risk scores to every payment and automatically block high-risk payments. Furthermore, Stripe algorithms adapt quickly to shifting fraud patterns and to your unique business.

- With Authorize.Net Accept.js, sellers don’t need to worry about PCI-DSS compliance accepting payments from their customers, as Accept.js sends payment data directly to Authorize.Net (aka Auth.net). The add-on also enables capture, refund, and void operations.

On top of that, PayPal and Stripe have chargeback protection programs that can shield merchants from fraud and invalid chargebacks.

At X-Cart, we offer a bunch of PCI-compliant third-party payment gateways that can securely handle customer financial data on your behalf. With the essential experience to securely accept online payments in online stores, X-Payments Cloud is an excellent example of a credible PCI Level 1 certified solution. It allows you to store credit card data on your website and remain compliant. Furthermore, X-Payments comes with a bunch of fraud screening solutions.

7. Level Up Fraud Protection

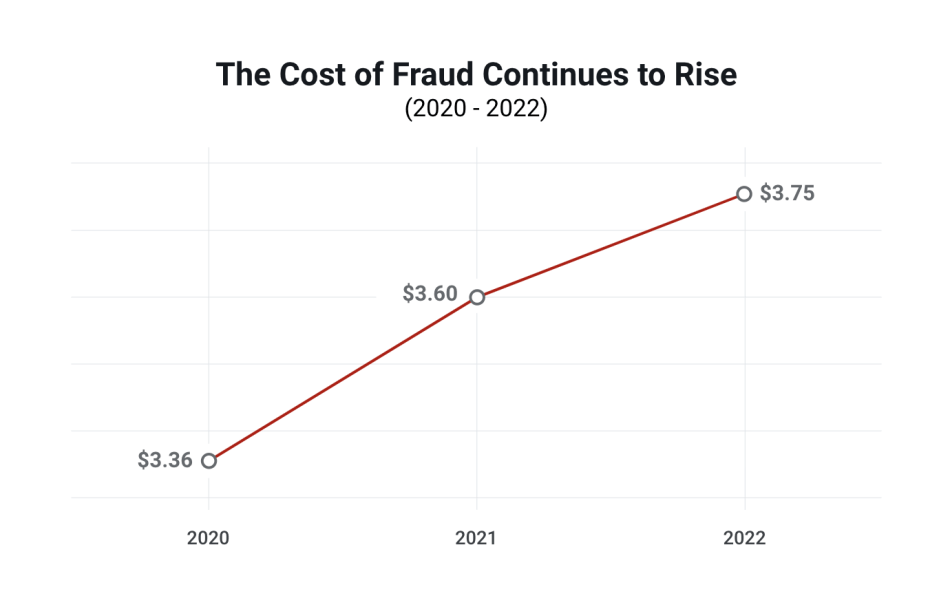

According to Chargebacks911, three-quarters of all fraud incidents in 2021 occurred in card-not-present channels. Given that the eCommerce industry is so attractive to hackers, no wonder that online sellers lose an average of $3.75 for every $1 lost to fraud.

While it is nearly impossible to eliminate the chargebacks entirely, regular manual reviews help protect your business from eCommerce fraud, significantly reducing the number of illegitimate transactions.

The main red flags indicating a fraudulent order are:

- More than one payment method is being utilized from a single IP address. This could be an individual using stolen credit card numbers to submit orders and receive goods they can sell.

- The billing and shipping addresses don’t match. Most software can only verify addresses properly within the US and UK.

- Large volume orders on a single item are coming from a new customer. This could be a cybercriminal acquiring a product to resell with someone else’s credit card.

- A series of orders are shipped to the same address but placed using different payment methods.

Additionally, you can implement robust fraud prevention tools, such as Signifyd or Kount, and configure system alerts for any suspicious activity.

Signifyd provides a 100% financial guarantee against fraud and chargebacks on every approved order. This guarantee shifts fraud liability away from online sellers and lets them focus on increasing scales, opening new markets, and building their brands.

Kount’s Fraud Protection Platform protects the entire customer journey, helping businesses stop chargebacks, reduce manual reviews, and accept more orders while reducing customer friction and false positives.

At X-Cart, Signifyd and Kount are available via the X-Payments Cloud connector, which also comes with a built-in NoFraud add-on.

With NoFraud via X-Payments, you can reduce fraud significantly and entirely escape manual review routines. Additionally, it gives sellers direct access to manage the X-Payments settings for NoFraud directly from the X-Cart admin area.

8. Implement Chargeback Prevention Tools

Integrating chargeback management software into your eCommerce website is a huge step to long-term chargeback protection.

The core features any chargeback management software include:

- Fraud detection identifies the user and the fraudulent behavior.

- Address Verification Service (AVS) compares the billing address stated on the transaction with the issuing bank’s address on file to decline potentially high-risk orders. The AVS is extremely useful while handling disputes with major credit card processors as it helps to provide accurate documentation.

- A Blacklist is a dynamic database of customers who have been charged back or have filed a chargeback dispute. It can be integrated with your customer relationship management platform (CRM) to allow you to identify, flag, and block potentially fraudulent charges.

- Automated chargeback management handles all the processes in the background, saving the merchant a lot of time and effort.

- 3D-Secure reduces fraud by letting you establish a PIN for credit card transactions and ensures that the cardholder and the person making the purchase match, adding a layer of protection and security.

- Chargeback alerts notify sellers of the received claims allowing them to resolve disputes quickly and reduce harmful impact on their chargeback rate.

- Post-chargeback analytics are essential for understanding the chargeback cause, studying buyer behavior, and thus identifying, preventing, and limiting chargeback fraud.

We’ll give you a quick overview of the five popular chargeback software solutions that tick all the boxes mentioned above.

Chargebacks911 is a solid chargeback management software solution that offers all the tools sellers need to collect evidence, submit it in the context of a dispute, and sift through the data for actionable analytics. Additionally, sellers get a single source for all the resolution templates, chargeback codes, and the types of evidence they need to submit.

Chargeback Gurus identifies reasons for chargebacks using over 40 data points, evaluates recovered revenue via an ROI calculator, and conducts a thorough prevention analysis to spot the most vulnerable to fraud areas.

MiDiGATOR is a tool designed to cover the process of the inevitable chargebacks that eCommerce businesses face. The software suite comes up with a single portal to monitor and handle all disputes in real time from the moment the chargeback is filed. It also can help you avoid the chargeback by automatically triggering a refund ahead of the costly chargeback process.

VeriFi is a Visa solution that works as an intermediary between merchants and issuers, allowing them to resolve customer disputes directly with the consumer.

Accertify’s Chargeback Management software provides an end-to-end payment solution that minimizes chargeback costs and comprises powerful workflow management, web-based reporting, and dynamic system updates.

9. Eliminate Merchant Error

Given that merchant error causes 20 to 40% of all chargebacks, sellers should do their due diligence to avoid them by implementing prevention practices and streamlining internal business processes.

- List merchant descriptors on bank statements

Ensure that consumers recognize a transaction by ensuring the merchant descriptor used by the card scheme is clear. For example, recognizable names such as the brand name for an online store or trading name result in fewer chargebacks than parent companies’ names.

- Watch recurring payments

With all the benefits of recurring payments (aka subscriptions) for merchants and customers, they also pose some chargeback risks. This is why monitoring your subscriptions is critical. Reminding the customer of a charge a few days before is helpful, especially if the billing rate has changed. Also, make cancellation a simple and painless process and promptly follow up on such requests, informing the customer if a request comes too late to stop the billing cycle.

FAQs

The chargeback protection methods will depend on where your chargebacks are coming from, and why you’re getting them. The best option is to analyze the data from your past chargebacks to learn the root causes behind them.

Amazon is always the first to be notified after a customer initiates a charge dispute; then, it notifies the merchant via email or Seller Central. After receiving a chargeback alert from Amazon, sellers should promptly address the claim in Seller Central. Although the essential chargeback prevention strategies also apply to Amazon sellers, there are some nuances to consider. Learn more in the article.

A chargeback win rate is a calculation that compares the number of successful chargeback responses against the number of chargebacks fought. Understanding your win rate is essential to determining the ROI generated from representment.

Final Takeaway: A Robust eCommerce Platform Backs up Your Online Business

Although chargebacks will always be a risk for online merchants, prevention is the cure in most cases. Thus, having consumer-friendly processes for handling returns and refunds, using secure payment gateways, and efficient fraud prevention tools diminish the number of buyer disputes, saving your revenue and nurturing customer loyalty.

The trickiest thing is to combine all this in one shopping cart solution, as some website builders offer little flexibility. But, like all eCommerce players, we understand the headaches of catching up with the unique demands of a growing business. To help you establish a solid base for your online store, we’ve developed easily scalable and flexible X-Cart software that will help you avoid a technology dead end. With a host of powerful add-ons and boundless customization capabilities, you’ll be able to integrate a third-party app of your choice, be it a chargeback management system, tax calculation tool, or any other, you decide!

Prepare a Solid Base for Your eCommerce Business with X-Cart

About the author