eCommerce Sales Tax for X-Cart Merchants, Demystified

This blog post was originally contributed by Mark Faggiano, the Founder and CEO of TaxJar.

eCommerce sales tax is one of those administrative hassles that can quickly turn into a mess for online sellers. In the U.S., no overarching government body handles sales tax, so businesses have to deal with different tax rules and tax laws from each state.

Not to mention, sales tax rates vary widely from state to state and even city to city. There are different tax rules for in-state and out-of-state (i.e. “remote”) online sellers. Some states collect gross receipts tax instead of sales tax.

If you’ve ever tried to search for comprehensive info on “eCommerce sales tax” or “online sales taxes” you probably already know there’s a lot of information out there. And it’s difficult to determine what’s relevant to your business.

That’s why we put together this quick eCommerce Sales Tax 101 guide to help online sellers handle their business tax. It will be useful both for those who already sell online and who are just creating an online store. Read on to demystify the wild world of internet sales taxes.

The Anatomy of a Sales Tax Rate

Forty-five states and Washington DC all have a sales tax. Sales tax is a small percentage (usually 4-8%) of a sale collected by a merchant and passed on to the state or local area. The money collected by sales tax is used to pay for public budget items like schools, roads, and public transit.

Some states only have one statewide sales tax rate. For example, Connecticut’s statewide sales tax rate is 6.35%.

But most states allow local areas like counties, cities and special taxing districts levy a sales tax, too. And that’s where sales tax collection can get complicated for online sellers. In most eCommerce transactions, the point of sale is your buyer’s ship to address. And in states with local sales tax rates, that rate can vary widely from town to town and county to county.

For example, the sales tax rate in midtown Atlanta, GA is 8.9% while the sales tax rate in neighboring suburb Marietta, GA is just 6%. And in some cases, a resident who lives outside the city limits would pay less in sales tax than a resident who lives inside city limits.

You get the picture. It can be difficult to determine your eCommerce buyer’s correct sales tax rate without a service like TaxJar SmartCalcs.

But before you even begin collecting sales tax in your online store, it’s important to know the basics of which merchant has to collect sales tax where. That’s where the concept of “sales tax nexus” comes in.

Sales Tax Nexus, Explained

In the U.S., due to Supreme Court precedent, only sellers with “sales tax nexus” in a state are required to collect sales tax from buyers in that state. Nexus is just a legalese way of saying a “significant presence” in a state.

The following factors generally create sales tax nexus:

- Your home state – you’ll always have home state nexus simply because you’re there

- A location – a store, office, warehouse, factory or other location where you have a physical presence creates nexus;

- An employee – employees, some contractors who work directly in your business, salespeople, installers and others create nexus;

- A drop shipping relationship – you may have nexus if you drop ship directly to your customers from a 3rd party supplier;

- An affiliate – some states consider 3rd party affiliates who send customers to your store to create nexus;

- Temporary business activity – In some states, if you sell within their borders for just a handful of days (such as at a tradeshow or craft fair) then you have nexus there.

If you have nexus in a state, then you are required to register for a sales tax permit and charge sales tax to buyers in that state.

Each state gets to make their own sales tax rules and laws, and each state’s tax laws are a little different. If you have questions about nexus, you can read what each state’s code of laws says about sales tax nexus.

Determining if your Products are Taxable

Most tangible personal property is subject to sales tax. However, some states have passed laws declaring some items non-taxable. Product categories not subject to sales tax in some states include groceries, medicine, clothing and textbooks.

If the products you sell are not considered taxable in a state, then you should not charge sales tax when you sell that item to buyers in that state. For example, clothing isn’t taxable in Pennsylvania.

If you sell a pair of blue jeans to a buyer in Pennsylvania, they are going to be irate if you charge them sales tax on that transaction.

On the other hand, if you forget to charge sales tax on that same pair of blue jeans to a customer in Colorado, where clothing is taxable, then you’d be on the hook to pay the sales tax your Colorado customer should have paid out of your pocket.

Fortunately, you can automate eCommerce sales tax collection on your internet sales. So you never have to worry about unhappy customers or owing money out of your profits to the sales tax collector.

Registering to Collect eCommerce Sales Tax

Once you’ve determined that you have sales tax nexus in a state and sell taxable products to buyer in that state, your next step is to register for a sales tax permit.

Register for a sales tax permit with your state’s taxing authority. Your state’s taxing authority is often called the [State] Department of Revenue. It can also go by other names. For example, you’d apply for your Texas permit with the “Texas Comptroller.”

Don’t skip this step! States consider it illegal to collect taxes from your buyers without a valid sales tax permit. You can find instructions on how to register for a sales tax permit with each state here.

Once your state issues your sales tax permit, they will also issue you a sales tax filing frequency and sales tax due dates. As a rule, states want higher volume sellers to file more often. You will generally be instructed to file monthly, quarterly or, if you are a lower volume seller, once per year.

Keep in mind that state sales tax due dates can vary widely by state. For example, sales tax is due by the 20th of the following month in Illinois. It’s on the 25th of the following month in Kansas. And it’s the last day of the month in California. Having trouble filing and paying eCommerce sales tax on time? You can use sales tax automation software to ensure you never forget a due date.

Setting up eCommerce Sales Tax Collection

Once you have your sales tax permits for your nexus states, your next step is to set up sales tax collection and begin collecting sales tax in your online store.

Also, keep in mind that you have to collect eCommerce sales tax in all of your nexus states on all of your online shopping carts and marketplaces. So if you sell on X-Cart but also sell on Amazon FBA, for example, be sure to set up sales tax collection there, too. The same works for eBay Etsy and other online marketplaces.

When it comes to how much eCommerce sales tax to actually collect on each transaction, your online shopping cart and marketplace will generally take care of this for you. However, it’s important to note that not all states are created equal when it comes to how to collect sales tax.

Some states are “origin-based sales tax states” and some are “destination-based sales tax states.” Origin-based eCommerce sales tax collection is fairly simple.

You, as an online seller, are only required to collect sales tax based on the tax rate at your home location. Most states, though, are “destination-based.” This means you are required to collect sales tax based on your customer’s ship-to location.

There is one more important thing to note. Some states require that you collect sales tax on shipping charges. Other states do not. You can avoid this by offering free shipping in your store! But if you do charge your customers for shipping, be sure to determine if shipping charges are also taxable in your nexus states.

Filing eCommerce Sales Tax

At this stage in your business’s sales tax life, you have determined where you have sales tax nexus and if your products are taxable, registered for sales tax permits with your nexus states, and have been collecting sales tax from your buyers. Now it’s time to figure out how much sales tax you collected and pay sales tax to the state.

This is where eCommerce sales tax filing can become maddeningly complex. States don’t want to know a lump sum of sales tax you collected from buyers throughout the whole state. (That would be too easy!) Instead, most states – especially those “destination-based” states – want you to break down how much sales tax you collected by county, city and other special taxing district.

Example

Let’s say you charged one customer who bought a product from your eCommerce store an 8% sales tax rate. Now you must break down how much of that 8% goes to the state, how much goes to the county where your customer lives, and how much goes to the city where your customer lives.

And if your customer resides in a special taxing district (such as an education or transit zone encompassing multiple local areas), you need to tell the state that, too.

The state wants to make sure that every local area gets the sales tax they are due. But for online sellers – especially those with a high volume or who sell on multiple channels – filling out a sales tax form can be a nightmare.

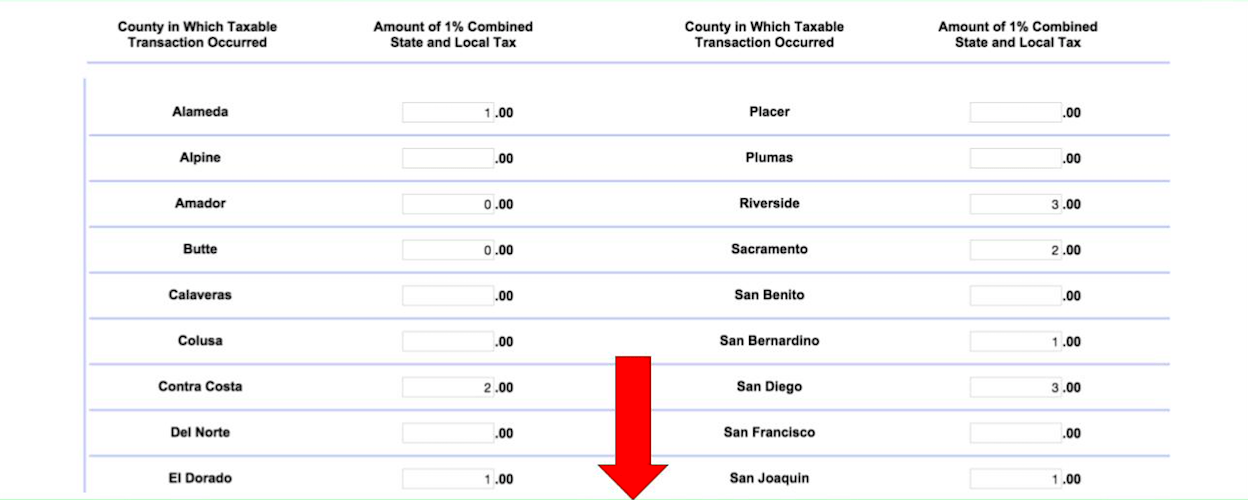

Here’s an example California Schedule B:

This is just one of 3 forms California online sellers must file to complete their California sales tax filing!

Fortunately, eCommerce sales tax automation software can handle this for you, too. No more fighting with spreadsheets or combining multiple sales tax reports.

Important things to consider

- File on time – Each state will charge a penalty if you file late, and interest on any past due amount that you haven’t paid yet.

- File “zero returns” – File a sales tax return by your due date even if you haven’t collected any sales tax over the taxable period. Failing to file, even if you didn’t collect any tax, could result in a penalty and even the revocation of your sales tax license.

- Don’t discount sales tax discounts – About half the states with a sales tax will allow merchants to keep a small portion (usually 1-2%) of the sales tax they’ve collected. This is free money, so don’t leave it on the table.

Once you’ve filed your sales tax return, you’re finished with sales tax until the next due date rolls around.

That was just the basics of eCommerce sales tax. For a whole lot more information on sales tax for online sellers, check out our Sales Tax 101 Guide for Online Sellers. Or join over 9,000 online sellers and sales tax professionals in our Sales Tax for eCommerce Sellers Facebook Group.

Installing TaxJar on X-Cart

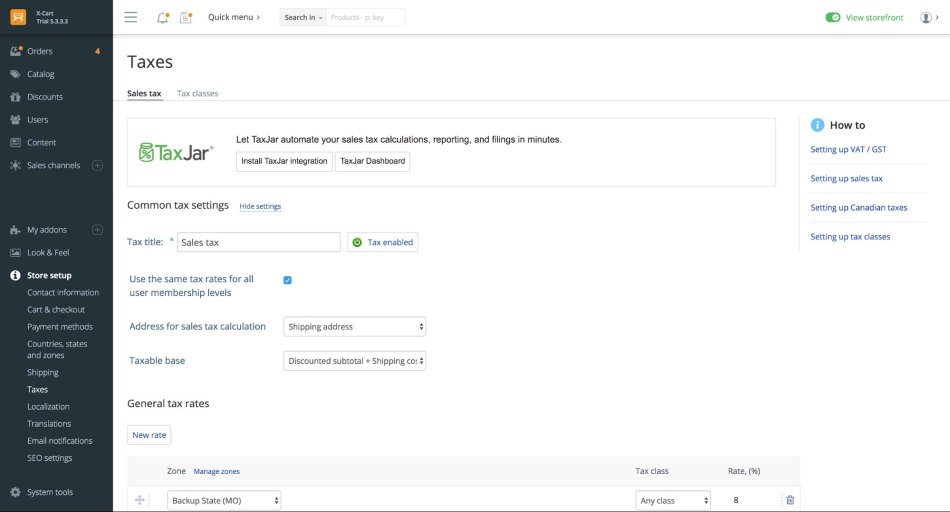

In your X-Cart admin panel, go to Store setup → Taxes.

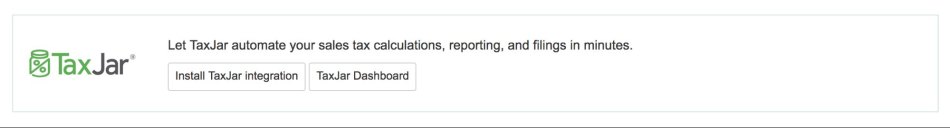

Click the Install TaxJar integration button inside the TaxJar box:

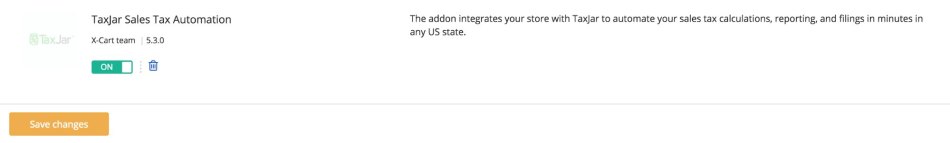

Toggle the “TaxJar Sales Tax Automation” switch to ON and click the orange Save changes button at the bottom of the screen:

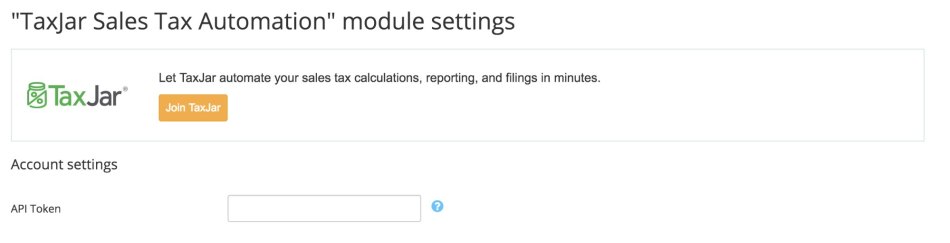

After TaxJar is enabled, click the Settings link to configure the module:

Click the orange Join TaxJar button to visit TaxJar.com and create a new TaxJar account:

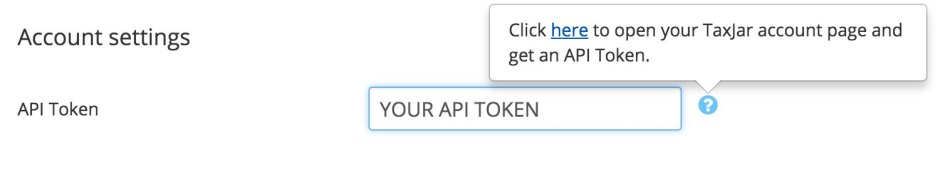

Generate a new API token in TaxJar. Copy and paste your API token into X-Cart:

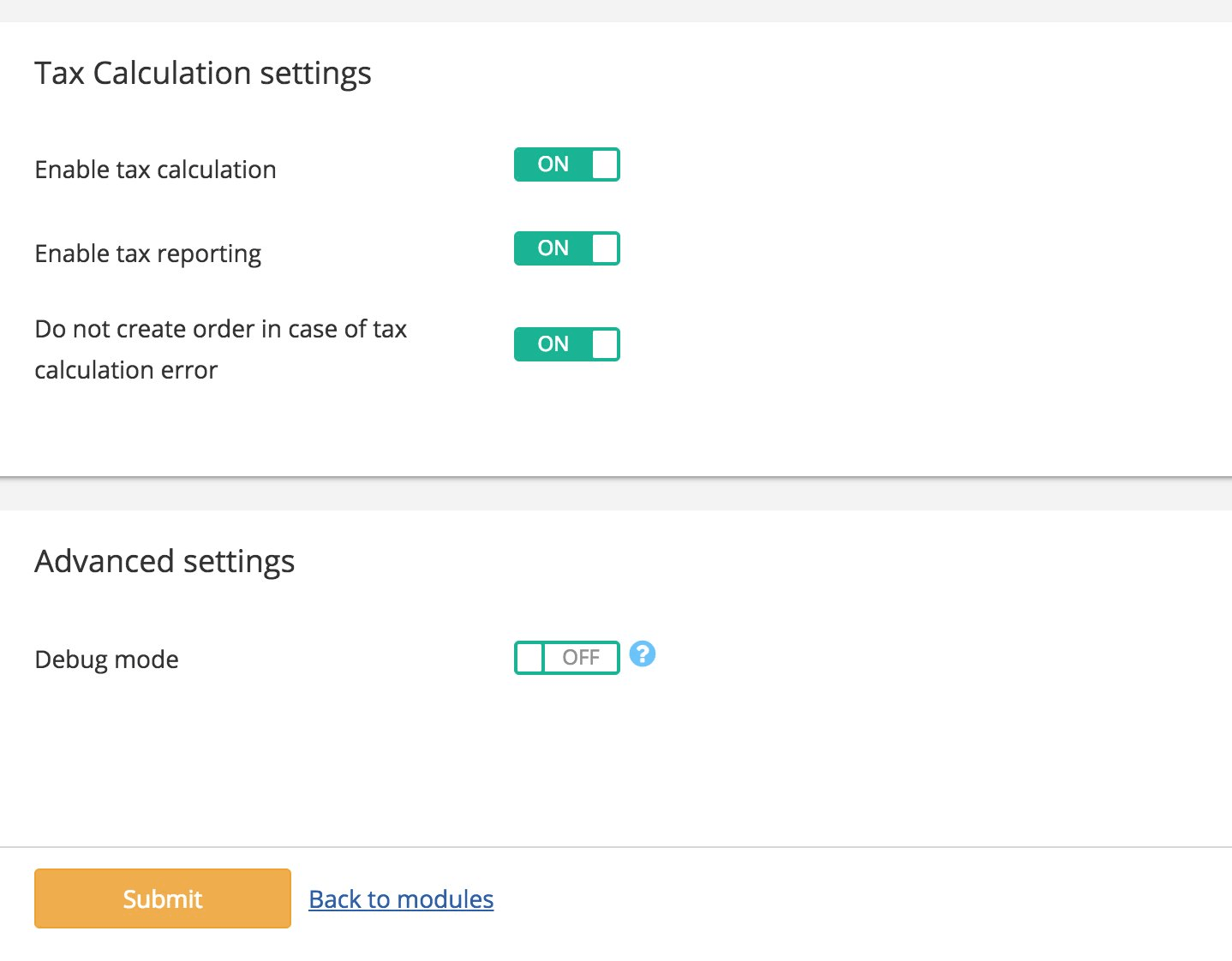

Toggle the settings you’d like under Tax Calculation settings and click the orange Submit button to save your changes:

You’re all set! Go back to Store setup → Taxes.

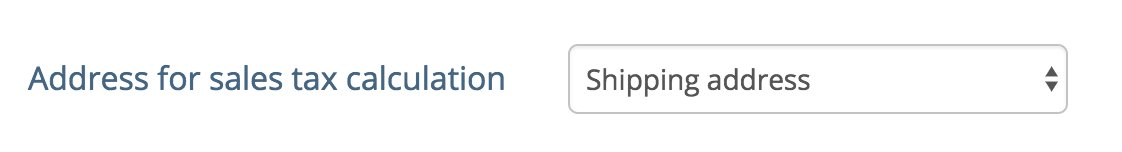

Make sure Address for sales tax calculation is set to Shipping address:

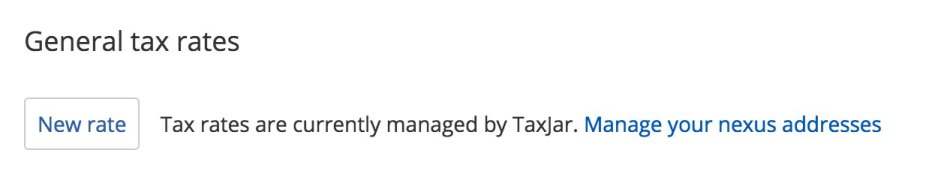

If you haven’t set up your nexus addresses in TaxJar, click the Manage your nexus addresses link:

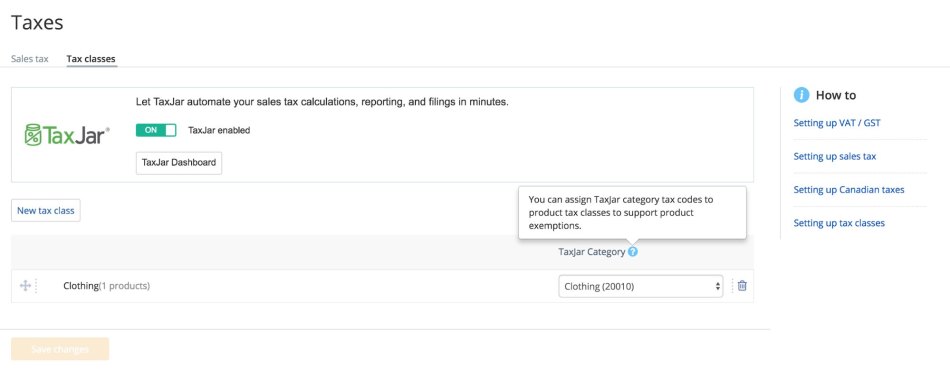

To take advantage of product exemptions such as clothing or food/grocery, click the Tax classes tab and assign TaxJar category codes to your product tax classes:

About the author