How to Avoid Chargebacks: Our Top 3 Chargeback Tips to Shield Your Auto Parts Online Store

Let’s face it: every store that sells products online is at risk for chargebacks. It doesn’t matter if you’re a health and beauty wholesaler, a healthcare supply outlet, or anything in between. So, why should auto parts suppliers be any different?

Suppliers in the automotive space are frequent targets for disputes and chargebacks. Why? Well, the answer includes a complex array of factors. Many of them are outside of the merchant’s control.

If you’re an automotive parts retailer with a profitable eCommerce component, you really need to know what you’re up against. You also need to learn how best to fight back.

But first, to understand everything I’m about to tell you, it’s important to fully understand what chargebacks are and how they affect your business.

Chargebacks 101

A chargeback is a credit or debit card charge that is forcibly reversed by an issuing bank. This typically happens because a cardholder claimed that a transaction was the result of fraud or abuse.

At their core, chargebacks are not a bad thing. They provide an important—and necessary—consumer protection that had been lacking in previous decades. Before regulation was introduced, many consumers were regularly fleeced by bad actors, and had limited recourse to resolve the problem.

Chargebacks are the primary tool banks use to resolve credit card payment disputes. When a consumer did not authorize a charge, or is unhappy with a product or service, they can challenge the charge with their issuing bank. If the bank feels the consumer’s claim is valid, they will initiate a chargeback in order to reverse the payment.

The trouble with this situation is that the customer isn’t always right. In some cases, they may even abuse the chargeback process deliberately.

It’s important to keep in mind that even the most reputable online businesses struggle with chargebacks. As I mentioned above, chargebacks aren’t supposed to be a bad thing. Because they exist, many consumers who might otherwise have had no recourse against a dishonest merchant or service provider are able to get their money back with limited hassle.

Issues arise when those customers get too comfortable with the practice. They may begin to side-step merchants’ terms of service and proper customer service channels, and head straight to their bank for refunds.

This is a phenomenon known as friendly fraud. It’s a form of first-party fraud in which a customer either accidentally or intentionally disputes a legitimate transaction with their bank.

When this happens, the merchant loses the revenue from the sale, as well as the value of the merchandise. They also lose out due to wasted overhead costs like shipping, fulfillment, and interchange, and are on the hook for fees assessed by their bank for every chargeback filed.

Chargeback issuances will add up over time and negatively impact the merchant’s chargeback rate. This could result in their account being frozen or even canceled entirely.

Understanding the Chargeback Process in 6 Steps

Now, before we get into the reasons why auto parts retailers are at a higher risk for chargebacks, let’s look closer at the chargeback process itself. From your perspective as a merchant, the chargeback process can be extremely complex and feature a lot of moving parts.

The number of steps involved in the chargeback process varies based on several factors. That said, here’s a basic rundown of a basic transaction dispute to illustrate how it works:

Step 01 | Chargeback Filed

The buyer identifies a bad charge on their credit card bill. For whatever reason, the cardholder bypasses the merchant in pursuit of a refund. They contact the bank and dispute the charge in question.

Step 02 | Issuer Review/Reason Code Assignment

The issuing bank reviews the dispute and assigns a chargeback reason code explaining why the consumer is disputing the transaction and proceeds with filing a chargeback.

Step 03 | Issuer Investigation

If the issuer determines the reason code is valid, funds will be clawed back from the merchant’s bank and then credited to the cardholder, who may see a provisional credit on their account. If the bank feels the case is unwarranted, the claim will simply be rejected.

Step 04 | Acquirer Review

The issuing bank will then forward the approved chargeback to the merchant’s acquiring bank for review. Any evidence the acquirer has to counter the chargeback will be submitted on the merchant’s behalf. If no such evidence exists, the bank will pass the chargeback along to the merchant, and debit the merchant’s account.

Step 05 | Merchant Review

If the cardholder’s claim is legitimate, the merchant must accept the loss. However, if a merchant can disprove the cardholder’s claim, they have the right to represent the chargeback to the issuer, along with a body of compelling evidence. If the merchant re-presents the transaction within the allowed time limit, the case will be returned to the issuer for reconsideration.

Step 06 | Issuer Second Review

If the merchant’s evidence refutes the cardholder’s claim, funds that were removed due to the chargeback will go back to the merchant. None of the chargeback fees or administrative costs will be refunded, though. The merchant alone absorbs the fee, regardless of a win or loss. If the merchant’s evidence fails to refute the cardholder’s dispute, the chargeback will stand.

Is the Deck Stacked Against Merchants?

As you can see from the outline above, the chargeback process isn’t exactly a fast or seamless process. Nor does it skew on the side of the merchant very often.

Again, the main reason for this is that banks tend to err on the side of their customers in a dispute. There is nothing inherently wrong with this “cardholder first” attitude. However, it can—and does— lead to a lot of illegitimate chargebacks being processed against merchants unfairly.

So, how does that happen?

I can’t state enough that chargebacks are an important consumer protection that absolutely should exist. But, perhaps the ease with which consumers can claim illegitimate refunds directly from their banks is the problem.

Most disputes can be set up directly from a banking app with just a few clicks and very few headaches. Banks and card networks need to start prioritizing the legitimacy of the claims being filed over the ease with which they are accessed. The key to this could be standardization of chargeback rules and processes across all card brands; until then, friendly fraud will remain a growing problem.

What Factors Put eCommerce Auto Parts Stores at Higher Risk?

The automotive industry in general, including its suppliers and wholesalers, is susceptible to fraud and chargebacks for some fairly unique reasons. While the situation will obviously vary from business to business, there are some factors that make this sector an appealing target:

- Auto wholesalers and financiers sell high-dollar ticket items.

- Online auto parts retailers often sell to various online outlets worldwide.

- Auto parts and supplies are frequently returned products (customer needs item A, for example, but orders item B by mistake, etc.).

- It’s common for buyers to default on auto part financing and payment plans.

- Auto parts manufacturers and suppliers are frequently impacted by supply chain problems, especially in a post-Covid environment.

- Auto parts manufacturing and retail is a high-demand space. This tends to attract fraudsters and disreputable customers.

Although an incredibly profitable industry, automotive parts sellers and suppliers are costly enterprises. They sell high-demand, high-ticket products on a global market with an irregular customer base. All this taken together will, necessarily, make them more susceptible to chargebacks.

Not All Doom and Gloom

Sure, it certainly sounds like bad news all around for auto parts merchants and suppliers. It actually isn’t, though. Being at a higher risk for chargebacks due to the factors outlined above doesn’t have to be a big problem for your business. One option is to work with a service provider that specializes in high-risk processing. You will likely pay higher fees to work with these processors, so the perks of high-risk processing still don’t eliminate the headaches associated with chargebacks. But, they do provide a few benefits that are sure to brighten your day, including:

- No set income cap (you can earn as much as you want without being penalized for high sales)

- You won’t lose processing privileges for excessive chargebacks

- Increased probability of financing approval

- Long-term profitability

- Increased currency acceptance

Another important point to consider here is the payment method used during a transaction. This is what ultimately dictates the cardholder’s chargeback rights.

Buy Now Pay Later Method

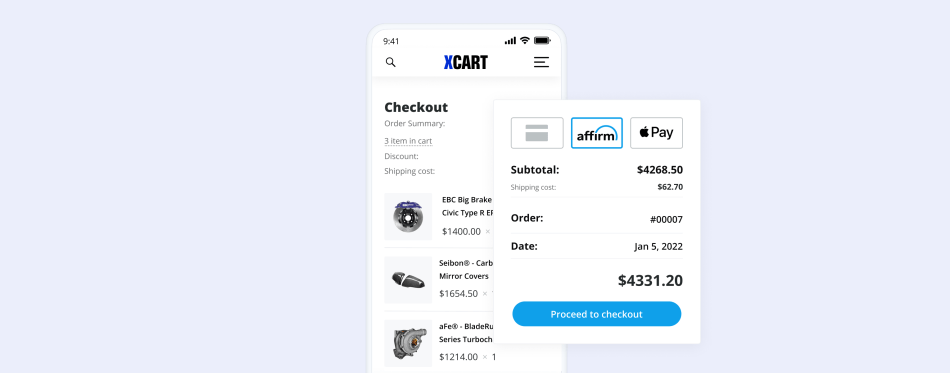

Take buy now pay later, or “BNPL” transactions, for example. These are not conventional card payments, meaning that the chargeback rights legally mandated under the The Electronic Funds Transfer Act (EFTA) do not apply. Any customer disputes involving a BNPL arrangement must be conducted through the bank and the service provider, rather than the merchant.

That’s not to say these purchases are immune to fraud or other forms of abuse, of course. BNPL purchases may still be subject to account takeover, synthetic fraud, or other fraud attack methods. However, many providers like Affirm, PayPal Pay Later, and Afterpay accept the liability for BNPL fraud that occurs on their platforms.

This is not a “get out of liability free” card for merchants, though. Even if it wasn’t the merchant’s fault, there’s a good chance the buyer will attribute the problem to the merchant, rather than the PSP. This can cause reputational damage, and will make buyers unlikely to come back in the future.

In the end, it doesn’t matter who your processor is, how forgiving they are of frequent disputes, or the payment method involved. No “magic bullet” can save you from fraud or chargebacks. The best approach is to target fraud and other chargeback sources, and eliminate issues wherever possible.

3 Basic Chargeback Sources for Auto Parts Merchants

Regardless of your processing status, it should be every merchant’s goal to limit their exposure to fraud and chargebacks whenever possible. You want to prevent every dispute before a chargeback occurs. To do this, a multilayered approach to prevention is your best bet.

My advice is first to assess the rate and frequency of the chargebacks you receive to determine weaknesses endemic to your specific business practices. Chargebacks tend stem from one of three primary triggers:

- Criminal fraud

- Merchant error

- Friendly fraud

Through in-depth analysis of past chargeback data, you can start to pick up on patterns, and determine which of these you encounter most often. From there, you can formulate a winning strategy. The key is to diagnose your chargebacks, then deploy the right approach to eliminate them before they happen. This is the only strategy that protects your business in the long run.

#1: Limit Your Exposure to Criminal Fraud

Criminal fraud accounts for any unauthorized transaction made with stolen or breached payment card information.

Data from LexisNexis suggests that the average US retailer suffered 727 successful fraudulent transactions per month in 2020. Given that the average fraudulent transaction stands at $174, this translates to $126,500 in monthly losses. However, criminal fraud chargebacks are generally easier to identify and respond to than other disputes, making prevention a more straightforward process.

Once criminal fraud has been identified as the source of a chargeback, you can take steps to limit your exposure moving forward. Criminal fraud can be mitigated by using and combining fraud prevention tools, including:

- AVS, CVV, and 3D Secure technology

- Geolocation

- Proxy Piercing

- Blacklisting

- Fraud Scoring

Important note: At X-Cart, we are offering powerful fraud screening solutions for your Auto Parts eCommerce website, such as Signifyd, Kount, or NoFraud, available via X-Payments Cloud connector. Get a 360-degree view of the X-Cart features to know how we can help you keep your profits safe.

These should be viewed as complementary components of a multilayer strategy. The more refined your detection strategy, the more fraud you’ll intercept.

No merchant can ever guarantee that they’ll defeat every instance of fraud. However, you can severely limit a fraudster’s chances of success by deploying fraud tools in a smart way.

#2: Eliminate Chargebacks Resulting from Merchant Error

Listen: no one is perfect. Mistakes can happen, regardless of the size or profitability of your business.

Chargebacks attributed to merchant error are a common enough occurrence that they account for somewhere between 20-40% of all chargebacks. “Merchant error” covers a wide range of seemingly minor policy and procedural missteps that can trigger chargebacks. Many will not be readily apparent to you.

The good news here is that merchant error chargebacks, like criminal fraud chargebacks, are preventable so long as you can identify the errors responsible and act accordingly:

- Make sure your billing descriptors are recognizable and include your logo, website address, and contact information

- Review your refund policy and terms of service. Make sure that they’re clear and are easy to find from any page on your site.

- Make it easy for customers to cancel a subscription.

- Always remind buyers of an upcoming recurring payment.

- Provide tracking and shipping information to your customers so they can stay in the loop on their goods’ location.

- Make sure your product descriptions are accurate and fully transparent.

- Prioritize prompt, friendly customer service. Provide live assistance as many hours a day as possible (24/7 is ideal).

There is no magic button that solves every problem you’ll encounter. But, with best practices like these, a great many of your chargeback issues can be all but eliminated.

#3: Fight Back Against Friendly Fraud

After eliminating most criminal fraud and merchant-error chargebacks, nearly all remaining claims you encounter will be cases of friendly fraud.

Preventing chargebacks from friendly fraud is a challenge. This type of fraud occurs post-transaction, making it hard to anticipate or mitigate the threat using traditional prevention tactics.

Your best option to defeat illegitimate chargebacks resulting from friendly fraud is to challenge every instance you come across. Preventing friendly fraud isn’t impossible; certainly, the best practices above will help with that. But, it is far more important to challenge illegitimate chargebacks every time you receive one.

The more often a consumer comes up against friction when attempting to fleece a merchant for refunds or goods, the less likely they are to repeat the attempt. Plus, it helps you establish stronger relationships with banks and the credit card company in question.

You can improve your odds of winning a dispute by:

- Knowing chargeback representment regulations, inside and out, before a dispute happens.

- Organizing essential documents well so they can be located and recalled quickly.

- Paying attention to deadlines and turning around chargeback responses as quickly as possible.

- Prepare a clear, concise, and professional rebuttal letter. Be firm, but not emotional.

- Respond to every illegitimate dispute. This is the best way to maximize revenue retention and protect your reputation.

Get Back in the Driver’s Seat

No matter how you approach the chargeback problem, there’s one crucial thing to remember: it’s not going to go away on its own.

Taking control of the situation now will prevent further issues and penalties further down the road. It’s the only way to safeguard your business and improve your reputation with consumers and financial institutions.

As I hope I’ve demonstrated, operating within a high-risk vertical doesn’t mean you have to accept fraud and chargebacks as a cost of doing business. But, without a proactive, forward-thinking approach, your chargeback losses will only continue to mount over time.

About the author