Interchange Fees in a Nutshell: 5 Super Important Things You Need to Know About It

This post was originally contributed by David Goodale, CEO at Merchant-Accounts.ca.

Over the past several years, business owners have become more aware of interchange fees, and how they impact their business. I’m a huge proponent of this because it has forced greater accountability in the payments industry, and empowered businesses to control costs and negotiate their processing fees more effectively.

Even though interchange is generally better understood, many business owners are still in the dark.

In fact, when doing keyword research one of the most searched phrases is “how to calculate interchange fees”, which indicates that many business owners are still confused, and are trying to better understand merchant industry pricing. One of the reasons that there is so little understanding boils down to the fact that interchange is a fairly complicated and confusing topic.

Complexity, or at least perceived complexity is often associated with operating an eCommerce business. It can seem overwhelming: everything from building your first e-commerce website, right through to establishing payments, dealing with PCI compliance issues, and negotiating your processing contract can be a challenge.

In this discussion, we won’t dig into every last facet and detail. Instead, we’ll concentrate on the important parts, covering the basics and getting you up to speed on the most important things about interchange, as quickly as possible.

Why Should You Care About Interchange?

Interchange has to do with the costs associated with processing credit cards. If you don’t understand it, you have no ability to control your costs, and can’t negotiate effective processing contracts with your credit card processor. It will ultimately lead to paying higher fees than you need to for your payment processing.

1. What is Interchange Fee?

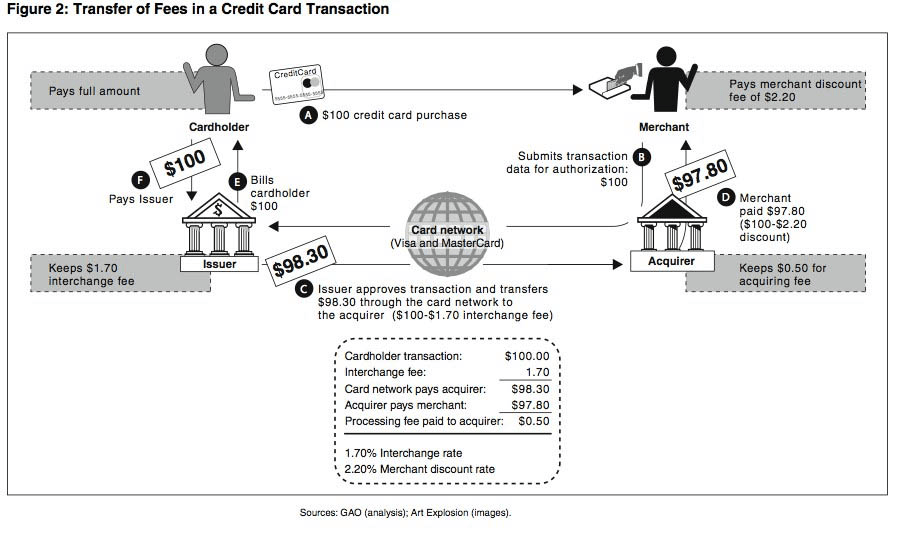

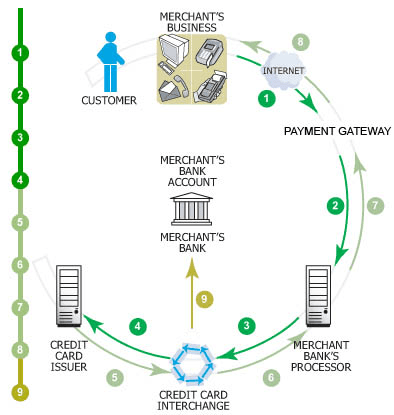

Interchange is the cost that payment processors incur each time a credit card transaction is processed.

As a business owner you are fully aware that you pay fees to your payment processor (called a “discount rate”) each time you process a credit card transaction.

What you probably didn’t realize is that the discount rate fees you pay to your processor are not all kept by the processor. A significant portion of the fees are returned back to Visa and MasterCard, and are ultimately onto the card issuing bank (the bank that provided the credit card your customer used).

Interchange can be summarized as the costs incurred by payment processors, as set by Visa and MasterCard, and are applied to every credit card transaction that is processed.

2. Interchange Fee Is Set by Region

Interchange fees are set at a regional level. All payment processing companies within a region incur the same interchange fees.

Regions are usually broken into countries.

For example, if you operate a US-based business, you are required to work with a US-based credit card processor and will incur US interchange fees. If you operate a Canadian business you will need to establish credit card processing in Canada, and will incur Canadian interchange fees. Visa and Mastercard rules require businesses to only work with credit card companies in their local country. A UK based business could not work with a US based credit card processor, because the US processor would not have a license to allow them to process transactions on behalf of UK businesses.

The concept that we are trying to drive home is that your business will be required to work with a credit card processor that is is based in the same country that your business is registered in. For this reason, the location of your business will ultimately determine which interchange structure will apply to your transactions, and it will impact the costs that you pay. Once you understand the concept it is easier to dig into and work out the bottom line impact.

The initial perceived complexity comes from the fact that interchange is very situationally specific for your particular business.

You need to understand two things:

- Interchange structures vary depending on region

- Interchange fees for transactions processed by your business are determined by the region of domicile (country) of your acquiring bank (payment processor whose banking licenses are being used to clear Visa and Mastercard transactions).

Once you understand these things some of the fog begins to lift and you can begin to work out the actual fees, for each card type, for transactions processed by your company.

The regions are broken down as follows:

- US interchange;

- Canadian interchange;

- EU interchange (Europe is seen as one acquiring region, and each country within that region has small differences, but as a whole European interchange is fairly consistent);

- Asia/Pacific interchange;

- Australia/New Zealand;

- Other regions.

This is helpful to know because if you are, for example, an American merchant and a payment processor offers you a seemingly unbelievable rate (interchange in the USA is more expensive than in Europe), you are able to compare your quote to the interchange rates to determine whether you are getting a good value or not.

You can look at card types in that region and see if they have quoted any rates that are below interchange fees on particular card types (such as rewards cards or premium cards), which is a surefire identifier of a suspect qualified/non-qualified rate quote that is best left avoided.

This is especially important because merchants will often receive confusing sounding quotations that are not based on interchange plus pricing.

Some payment processors having pricing models that are, in some cases, quite misleading.

As a business owner, you need to clearly understand that not all merchants receive interchange plus pricing and that other pricing models, especially qualified/non-qualified pricing, can cause many problems for small business owners.

Achieving an understanding of interchange fees for the region that your business is domiciled in will have you well equipped to spot which quotations may provide the best potential value, and dismiss the ones that otherwise “sound” good, but in the end would actually cost your business a lot more money.

Interchange Fees Depend on How a Credit Card Is Used

The way that a credit card is used will impact the interchange fee. In the industry this is sometimes referred to as the “presentment type”.

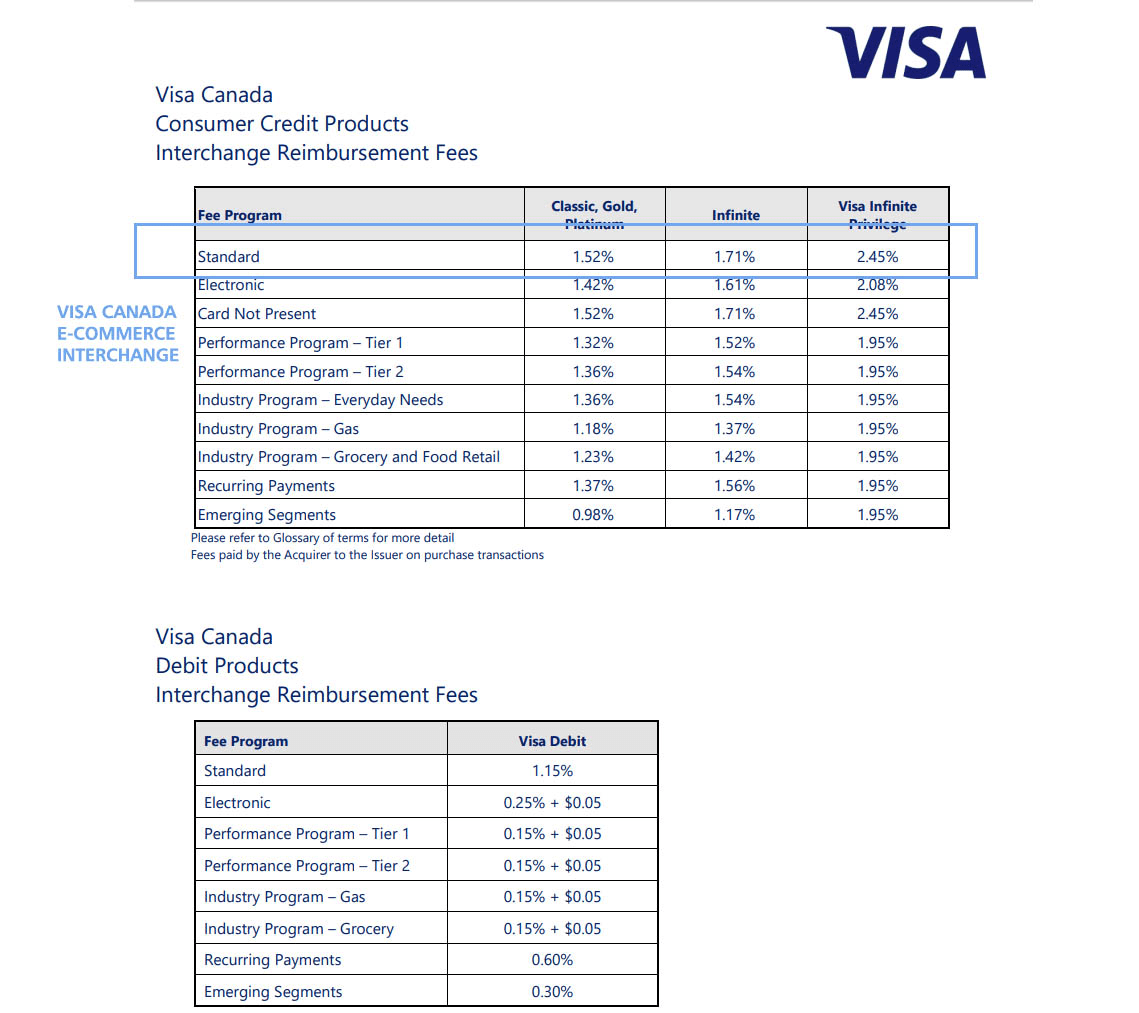

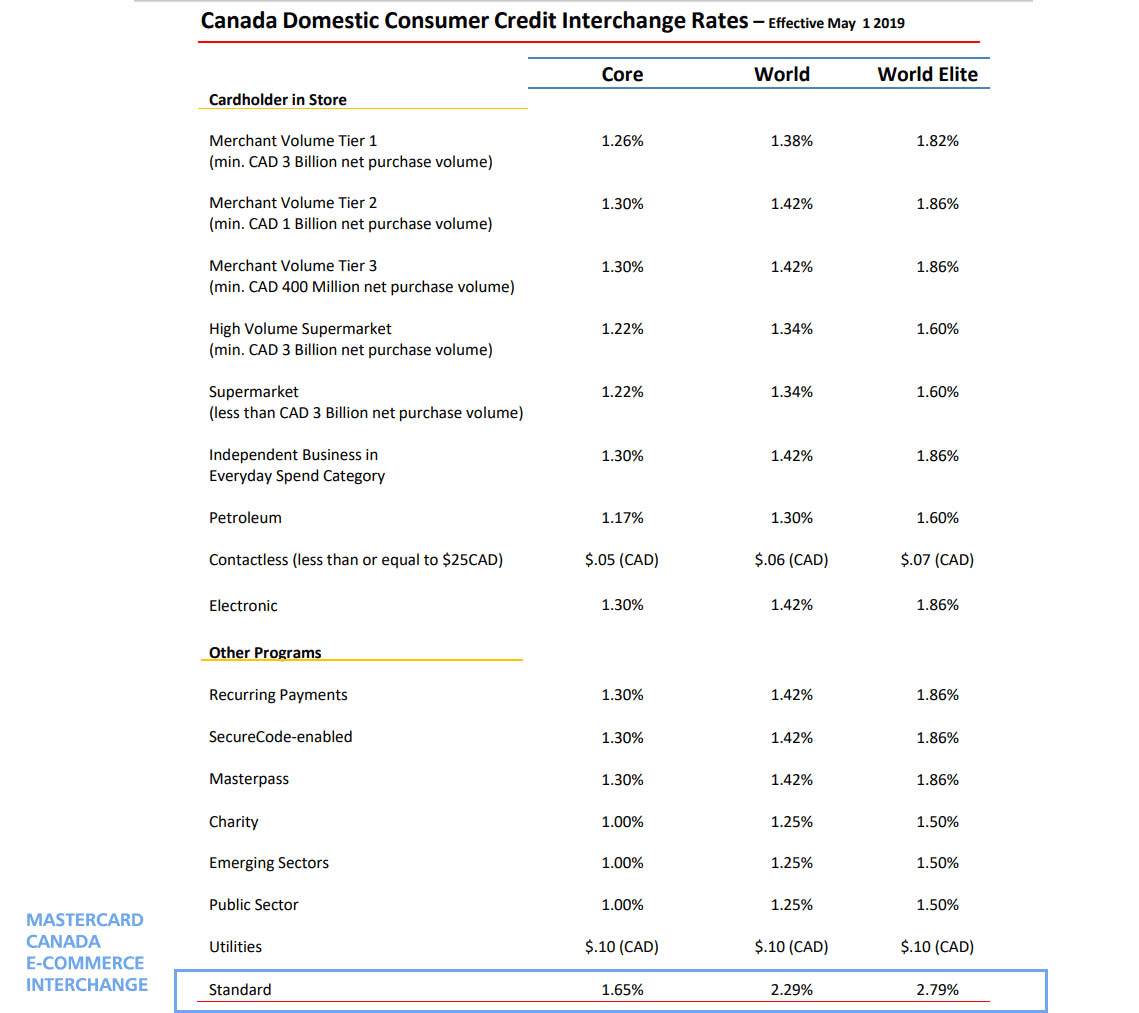

For example, retail (in-person transactions) have a lower interchange rate associated with when compared to e-commerce or card not present transactions. In Canada, at the time this article was written, e-commerce transactions have an interchange rate that is 0.11% higher than a retail/brick and mortar transaction.

Sometimes there are special situations where the presentment type can actually cause interchange to be lowered.

For example, recurring billing offers a lower interchange rate than regular eCommerce transactions.

This is probably because the risk associated with a recurring transaction is generally lower than for a new 1-off transaction.

There are other special interchange tiers available that offer rate savings to certain businesses, such as:

- supermarket interchange

- gas station interchange

- non-profit interchange

- emerging markets interchange where Visa or Mastercard want to encourage greater adoption of card payments.

3. Different Card Types Have Different Interchange Rates

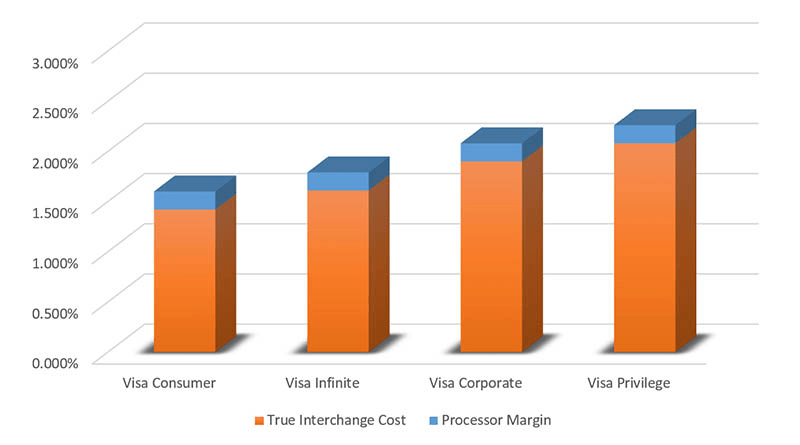

Within each region, different card types have different interchange fees. In general, basic credit or debit cards have the lowest interchange rates.

Rewards cards, such as cashback, air miles and points type cards (the cards that provide the cardholder with special benefits) have higher interchange rates.

Ultra-premium rewards cards and corporate cards most often have the highest interchange rates associated with them.

You can search on Google to find the local Visa or Mastercard website in your region. From there, depending on your region, you should be able to find the official interchange rate for your country.

For example, you can find information about Canadian interchange from Visa Canada.

The same information about Canadian interchange fees can be found on Mastercard Canada website, as well.

If you want a general point of reference in terms of costs, in North America interchange generally ranges from about 1.5% to 2.5%, but it depends strongly on type of card being used, and how it is being used.

In Europe interchange is much lower and is generally capped at 0.30% for any cards issued within the EU, even most rewards cards (but not corporate cards).

4. Cross Border Fees Are an Additional Cost to Be Aware Of

It’s beyond the intended scope of this article to speak too much about cross border fees.

You can find more information in this blog post or at a YouTube video about cross border fees.

Source: Youtube

What you need to know, at a high level, is that there are significant processing costs that are incurred when a transaction crosses a border.

For example, if a Canadian based merchant sells to a UK based cardholder, a cross border fee will be applied to that transaction. For a quick point of reference, the cross border fee for that a Visa transaction would be 0.80%, or 0.40%, depending on the transaction currency. Mastercard has recently increased the cross border fee to 1% in November of 2018. The takeaway point from this is that cross border fees can be a significant cost to your business.

Interchange Optimization Can Lower Cross Border Fees

It is possible to reduce or eliminate your cross border fees by optimizing your payments infrastructure to utilize local (domestic) processing in each region in which you have a significant amount of customers.

Cross border eCommerce is a specialized area of the payments industry, which focuses on interchange optimization for global businesses.

It’s something that many businesses don’t consider — but can save a lot of money. Some credit card networks provide interchange optimization, which is the process of helping your business to eliminate cross border fees and qualify for the lowest interchange rates in countries where you attract a lot of customers.

This requires establishing local merchant accounts in each region, which will require you to maintain a business presence in each of those regions.

Doing so will provide your business with the lowest possible interchange rate for each transaction that your business processes. However, because it can only be done if your business has, or is willing to maintain a business presence in different countries, it would usually only make sense to do this where you have at least $100,000 per month in sales. (Which is only intended as a point of reference figure and needs to be looked at individually by every business).

For example, if your business had a lot of sales in the UK, but you operated a US-based business, it might make sense to set up a local company and to work towards making sure your sales in the UK qualify for domestic UK interchange.

While acknowledging that this is a fairly complicated project that only make senses for mid-sized or large businesses, the cost savings can be significant, and the more volume that your businesses process the more it is worth exploring.

After adding in FX costs on settlement of transactions, the rate savings can easily top 1%. If you are processing high transaction volumes it can quickly become worth investigating.

There will likely also be tax and compliance rules to work through, so it is best to speak to a company that has expertise in international and cross-border e-commerce payments.

5. Interchange Fees Are Adjusted from Time to Time by Visa and Mastercard

Interchange is adjusted periodically, often in April and October of of each year.

In Canada, merchants must be advised of these changes before they go into place, and if there is an interchange cost decrease the savings must be passed onto merchants or the merchant can cancel their processing agreement without penalty. (Courtesy of the Canadian code of conduct for credit card processing).

The obligation for payment processors to pass through savings (where interchange has been decreased) does not exist outside of Canada, however, if you stay aware of interchange adjustments, and if you are aware that interchange rates have decreased, it gives you a very strong negotiating position when renegotiating your rates with your payment processor.

On the flip side, if interchange rates increase your payment processor may choose to either absorb the increase, or pass it through.

If you are paying low rates to your payment processor it may actually be impossible for the payment processor to absorb a cost increase without being in a loss-taking position (depending on your rate and pricing model).

Summary

As we’ve explored in this discussion, one of the reasons that interchange is little understood is because there are several aspects to it, all of which must be factored in and considered to understand the fee applied to any particular transaction.

There are a lot of different types of Visa and Mastercard cards in circulation, and each has its own issuer, card type, and even beyond that there are the presentation types:

- Online e-commerce & over the phone (virtual terminal)

- In-person

- recurring billing, etc.

As opposed to trying to learn everything about interchange, which isn’t necessary for the typical business owner, it’s best to hone in on the interchange fees that will specifically impact your business.

You should know the two most popular interchange tiers:

- standard interchange is for e-commerce and virtual terminal merchants

- electronic interchange is for POS/retail merchants

You should seek out the interchange guidelines for businesses in your country, directly from the regional Visa or Mastercard website for your particular country.

That will give you a handle on the actual costs that your merchant services provider will incur each time a transaction is processed. You will have a good and confident general understanding of the fee that your credit card processor will incur when processing transactions, and can look at your rate and determine if you are being charged a fair and reasonable service fee.

Anything you pay to your processor over interchange should generally be considered as margin or fees being earned by your processor. It’s certainly fair for them to earn a reasonable fee for providing a reliable processing service, and it should be consistent, reasonably easy to understand, and ultimately not an eye-watering markup that is unfair to your business!

This has been a crash course on interchange, and hopefully it will give you some confidence the next time that you are negotiating the payment processing rates for your business. The good news is that broken down into its component pieces, it’s actually very manageable. Especially when compared to the challenges like entering into an emerging e-commerce market like China!

About the author