An In-Depth Online Seller’s Guide to eCommerce Inflation: 7 Ways to Protect Your Profits

Let’s face it: people throughout history have been bouncing back from pandemics, wars, and natural catastrophes. After we get over the first shock, there’s inevitably a period of crisis to endure before a recovery.

Right now, it looks like we are in the middle of the crisis phase, confronting the post-pandemic economic struggles coupled with gas and oil-related supply chain disruptions and overall price increases.

Under these challenging circumstances, business owners should take their gloves off and protect their profits. And eCommerce sellers are no exception.

To help online store owners navigate their inflation risks, we’ve conducted research that sheds light on such burning questions as:

- What is inflation?

- How did we get there?

- How does inflation influence consumers and businesses?

- How does Inflation impact the eCommerce industry?

- What eCommerce trends does the overall price increase bring out?

- How can online sellers inflation-proof their eCommerce stores?

- How can X-Cart help sellers develop efficient sales strategies to combat inflation?

Read on as we dig into the current inflation bottlenecks, reveal the shift in customers’ shopping habits, and highlight key business strategies to help you keep your online store afloat in the face of economic woes.

Consume Content on Your Terms

Ⅰ. First Thing’s First: What Is Inflation?

By economic definition, inflation is a decrease in money purchasing power, which results in higher prices of goods and services. Simply put, a dollar in your pocket doesn’t buy as much as it used to.

In Sam Ewing’s words, inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair. Whereas the moderate price increase reflects positive economic growth, steep inflation rates indicate the contrary.

Measuring Inflation

The inflation rate is measured and monitored by the Federal Reserve. The officials evaluate a combination of price indexes such as Consumer Price Index (CPI), Personal Consumption Expenditures Price Index (PCE), Producer Price Index (PPI), and Employment Cost Index (ECI), to name a few.

Price Indexes’ Interpretation:

CPI measures inflation experienced by consumers in their day-to-day living expenses and represents a basket of goods and services that a consumer would buy when prices change.

PCE measures price changes in consumer purchases applied to all households and nonprofit institutions. Compared with PCI, it encompasses a broader range of goods and services from a greater variety of buyers.

PPI assesses inflation at earlier stages of the production process by indicating the average change in the selling prices received by domestic producers.

ECI gives an insight into the labor market, detailing the changes in business labor costs.

After looking into price trends, the economists choose the right strategy for controlling inflation and stabilizing prices by maintaining the interest rates.

We are coming closer to the most pressing questions that bother hundreds of millions of Americans: How high is the inflation rate in 2022, and what challenges does it present for consumers and business owners?

Let me fill you in one step at a time.

II. Inflation in 2022: Reasons & Effects

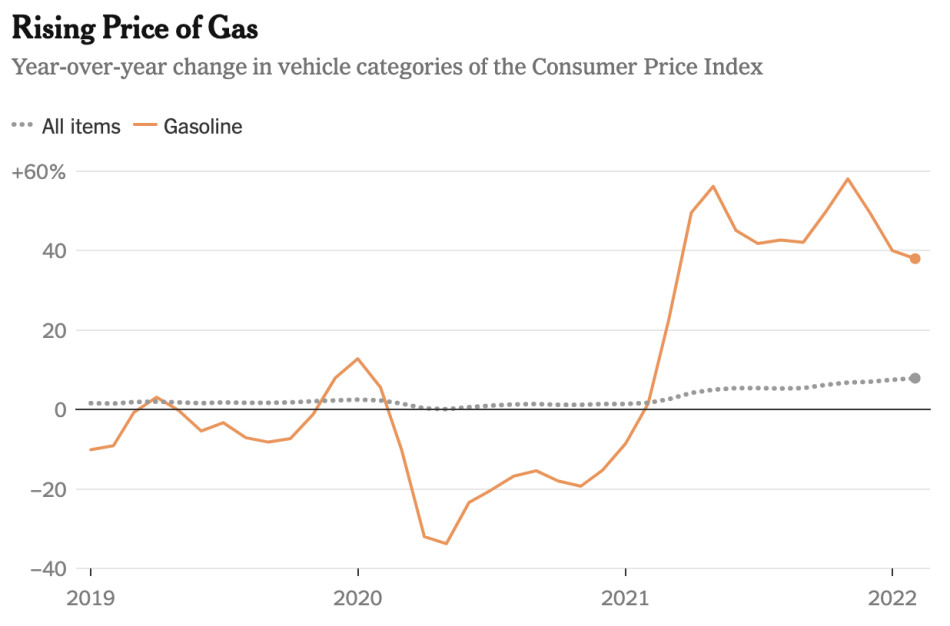

In February 2022, the Consumer Price Index (CPI) was about 7.9 %, indicating the fastest annual inflation pace in 40 years.

As of May 2022, the overall economic inflation rate in the U.S. grew even higher and reached 8.6%.

Update: one year later, by April 2023, the overall economic inflation rate has crawled down to 4.0%, which is the lowest increase since April 2021.

Given the statistics, the question naturally becomes: is the economic situation that bad, and is inflation going to persist?

To understand this, let’s look into the main reasons for the price bump.

Why Is Inflation Happening?

The current inflation is caused by several factors. Most of them revolve around the pandemic-related economic disruptions that were the early triggers of the ongoing crisis.

Supply Chain Disruptions

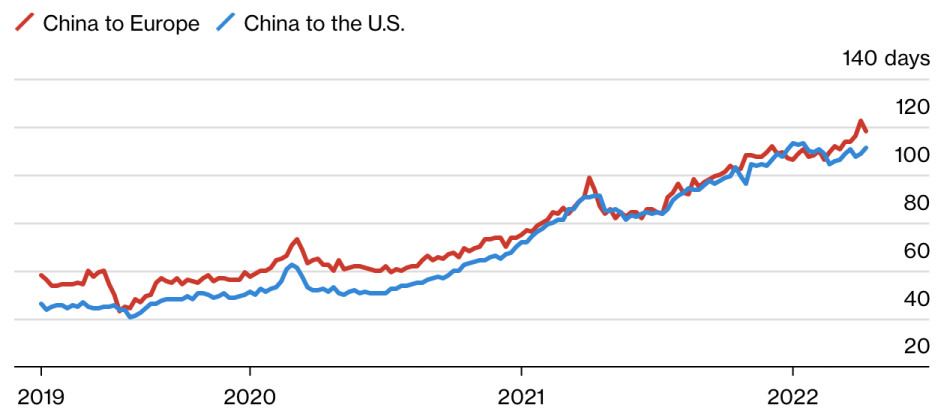

Despite the significant liberalization of the COVID-19 restrictions, we are still facing the after-effects of global lockdowns. As noted by Bloomberg, it takes an average of 100 days for goods coming from Asia to reach a warehouse in the United States.

The delivery delays for ocean freight have more than doubled, causing significant product shortages. The most severe bottlenecks affected raw materials, intermediate manufactured goods, and freight transport.

Imbalance in Supply and Demand

On top of logistics issues, the price increase is seen as the effect of the intensified post-pandemic purchasing power. While isolation and social distancing made it hard for factories to operate at full capacity, the demand remained high, exacerbating the issue of goods shortage.

A host of factors creating this imbalance include:

- Savings accumulated by U.S households. According to a McKinsey report, U.S. consumers have roughly $2.8 trillion more in savings than before the pandemic started. And they were eager to spend them.

- The fiscal stimulus for post-pandemic recovery. While the prices stayed high, the government took measures to raise the wages and make them meet the rising costs of goods and services.

The increase in customer spending power on top of government cash infusions accelerated the devaluation of the currency. This, in turn, pushed up prices affecting everything from groceries to gasoline.

Energy Costs Increase

Two main factors are driving the surge in oil and gas prices:

1. Recovery from the pandemic

People weren’t driving much during the pandemic, and businesses were shuttered. Therefore, the need for petroleum products and gasoline prices came down. However, fuel costs rose dramatically after the drastic increase in post-pandemic demand, which didn’t match the supply capabilities.

2. The war in Ukraine

Economic sanctions on Russian oil and gas increased the scarcity of crude oil and made gasoline production more expensive. This cost is passed on to consumers in the form of higher fuel prices, impacting the logistics systems across the industries, including eCommerce.

The increase in energy costs is not just the post-effect of inflation, but also one of the factors exacerbating it.

How Inflation Affects Consumers

According to a recent poll from the Wall Street Journal, over 80% of surveyed consumers are pessimistic and unsatisfied with their financial situation.

In the current economic landscape, regular American consumers are confronting significant challenges.

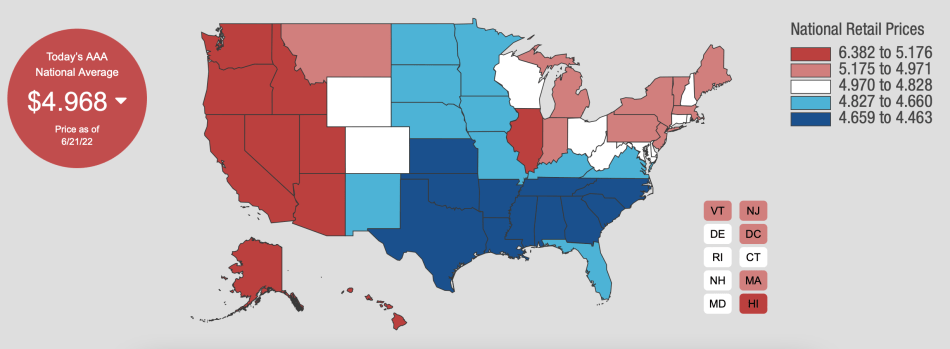

High Fuel Prices

Going by the latest AAA research, retail gasoline prices are over 5 dollars per gallon and rising, with prices higher on the west coast, Alaska, and Hawaii, while they are lower in more central states.

As of 2022, the expenses for gasoline make up about 6% of consumer spending, compared to the pre-pandemic 3%, which suggests a corresponding drop in spending elsewhere in household budgets.

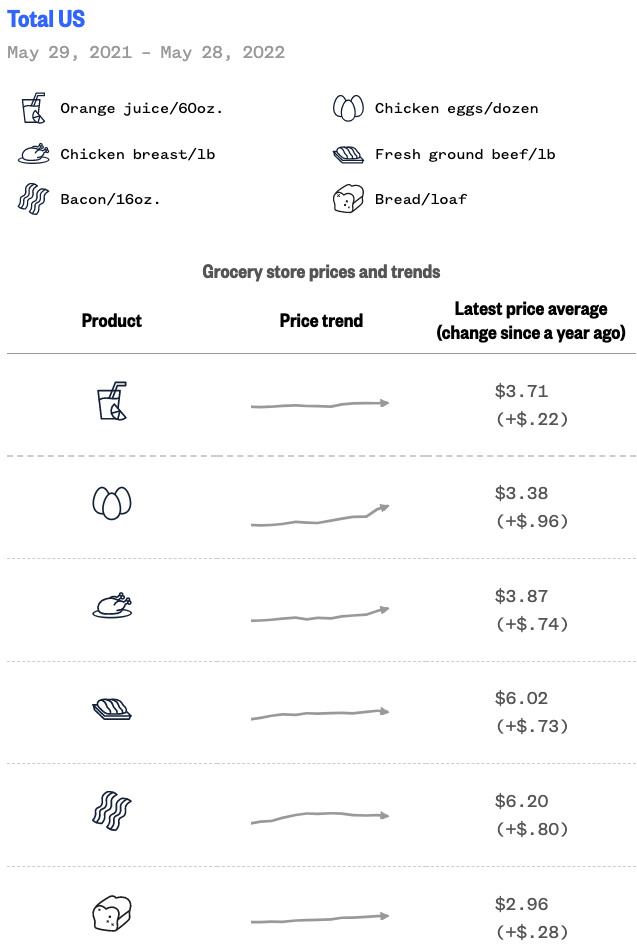

Soaring Food Prices and Product Shortages

For many families, the rising cost of food and groceries is one of the first noticeable things. With the inflation rate up in the past few months, the Consumer Price Index for food reached 10%.

Here’s a quick overview of the grocery prices increase year-over-year:

It’s worth noting that inflation hasn’t hit all types of food evenly. For example, fruit and vegetables haven’t increased nearly as much as meat and eggs. Egg prices spiked by 22.6 %, while the cost of baby formula jumped 18% over the last year amid its nationwide shortage.

Along with the baby formula, Americans are coming up empty on everything from raw materials to food and tools.

12 Things That Are in Short Supply Right Now:

– gas

– baby formula

– household products (including toilet paper, diapers, and feminine care products)

– pet supplies

– computer chips

– used cars and rental cars

– sunflower and olive oil

– corn

– timber

– brick

– lithium

– chlorine

Increased Mortgage Rates

Even though the central bank’s decisions don’t drive mortgage rates as directly as other products, the overall price inflation also pushes home loans.

As of June 21, 2022, the average rate for the benchmark 30-year fixed mortgage is 6.01%.Under these challenging circumstances, housing becomes less affordable for potential homebuyers. According to the Mortgage Bankers Association, mortgage applications for home purchases in June were down more than 15% compared to last year.

Higher Cost of Living

Whereas food prices, gasoline costs, and mortgage rates go up, they stress the families’ abilities to save money and increase the U.S. cost of living.

When wages don’t catch up with the constantly rising costs, consumers literally start living paycheck to paycheck. Therefore, they tend to spend less, looking for bargains and prioritizing cheaper alternatives.

Let’s see how this shift in customer behavior affects business owners.

How Inflation Impacts Businesses

While shoppers struggle to align their budgets to constantly rising prices, entrepreneurs try to keep their businesses afloat by cutting costs and reducing the staff. For example, Elon Musk, CEO of Tesla, announced his plans to freeze hiring and cut staff at Tesla by 10%.

More and more top executives across the industries have started expressing concern about the current economic situation and its adverse effects on their businesses.

And, here are the main challenges that businesses encounter in the face of inflation:

? Higher freight costs. The rising fuel cost means that anything transported on a truck, train, or ship is affected.

? Decrease in consumer purchasing power. Given the rising expenses, consumers tend to pare their spending, which can lead to a reduction in sales and a decline in business revenue.

? Raw materials shortage. Supply chain disruptions and increased gasoline prices can lead to insufficient raw materials, production delays, and nationwide product shortages.

? Higher inventory costs. The raw materials price hike translates into higher inventory costs for businesses that can eat into profits and reduce the company’s bottom line.

? Increased competition. As fast as inflation accelerates, businesses strive to maintain market share, which leads to fierce competition and puts more pressure on profit margins.

However, not all businesses face the same headwinds in the current economic landscape. In fact, some corporations are reaping record profits despite the challenges mentioned above.

What happens is that companies pass rising supply-chain costs onto consumers and maintain their profit margin by charging higher prices as input costs rise.

Industries that keep their profits despite (or thanks to) inflation:

| Industry sectors | One-year price change | Details |

| Energy | +64.8% | Big oil companies have high operating leverage, which helps them deliver a high-profit margin. On top of that, geopolitical and logistical tensions affect the energy supply and drive up prices. This makes the energy sector one of the best performers during periods of high inflation. |

| Financial companies | + 1.5%-1.75% | When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders. |

| Air transportation | +23.0% | While airfares and fuel costs go up, consumer demand is also rising. For example, prices of tickets sold for this July were 35% higher than tickets sold in July 2019. |

| Automotive aftermarket | +16.1% | Whereas other products may see a volume decline as price goes up, that doesn’t happen with motor vehicle parts. With demand on the rise, the total U.S. light-duty automotive aftermarket sales are forecasted to increase by 8.5% in 2022 |

| Consumer staples | Food: +10.1% Commodities: +8.5% | People keep shopping for food and household products despite the rising prices. |

III. Inflation and eCommerce

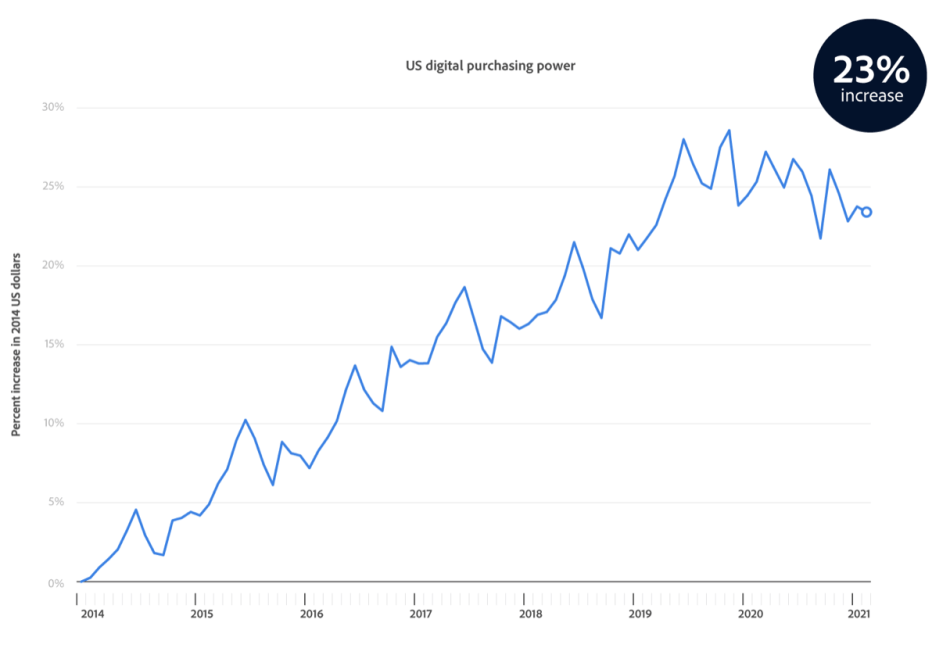

Going by Adobe Digital Economy Index, pre-pandemic online prices were declining at an average rate of 3.9 % every year on the back of the 23 % increase in digital purchasing power.

Not anymore.

To a certain extent, eCommerce inflation reflects the overall economic inflation rate. Even though online sales benefited from lockdowns and social distancing, the new economic challenges brought a decline in buyers’ purchasing power, high freight costs, and supply chain disruptions.

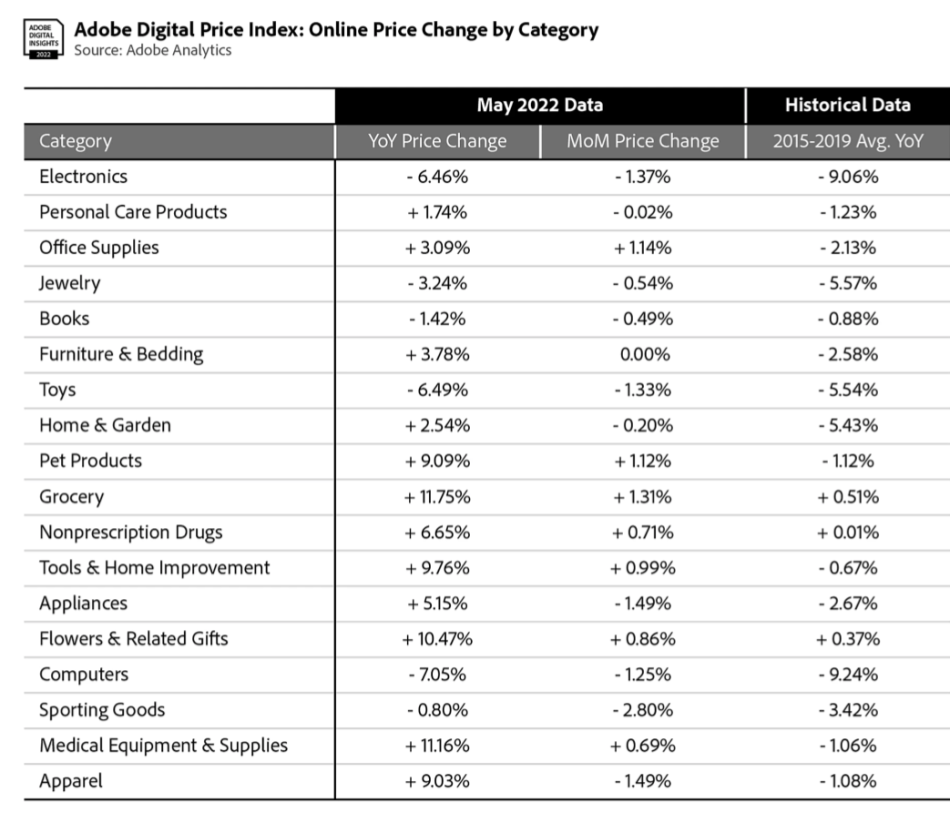

As per Adobe Digital Price Index, digital prices went up by 2.9% year-over-year.

What eCommerce Challenges and Trends Does Inflation Bring Out?

Under the logic that online prices are on the rise, eCommerce store owners are supposed to see more profit. However, it’s not all that simple. With the supply chain impacts on freight costs and stock availability, here come new challenges and trends to keep an eye on.

1. eCommerce Sales Slow Down

As of April 2022, American online shoppers spent $5.28 billion less than they did in March. At the same time, a discount retailer, Big Lots, announced it had missed its sales plan by approximately $100 million.

Consumers are being more careful and diligent about their expenses as prices go high. So while online grocery stores can see an irrelevant decline in traffic and sales, eCommerce retailers selling non-essential and luxury goods risk their profits.

To top it off, shoppers who turned to online sales for safety and convenience may now return to in-person experiences as the pandemic recedes.

2. Online Shoppers Seek Out Discounts and Better Customer Experiences

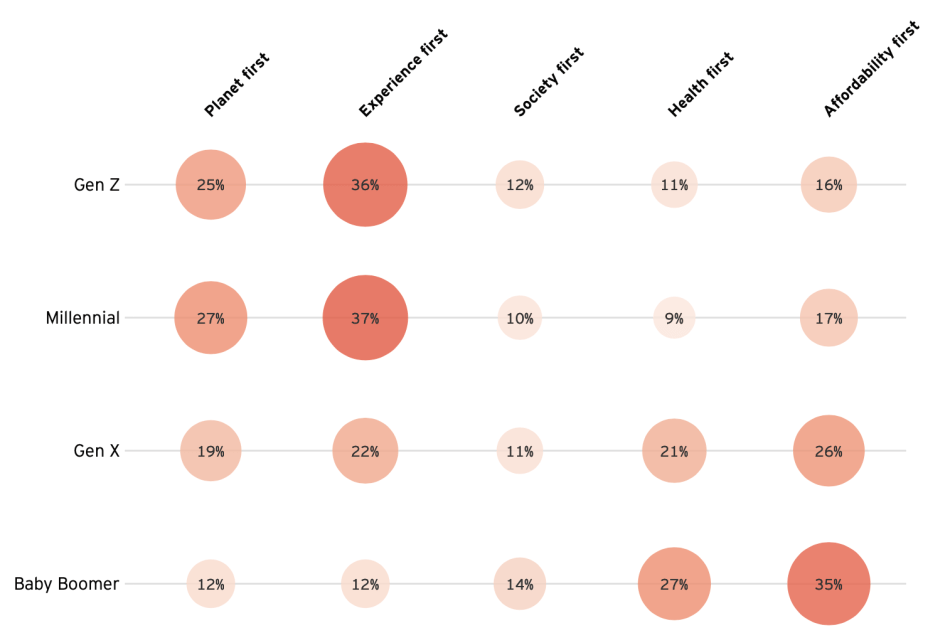

While keeping a tight hold on their wallets, customers seek more deals and discounts than ever. This presents an opportunity for eCommerce brands to build consumer loyalty with the right products, perks, and promotions to meet shoppers’ needs.

According to the EY U.S. Future Consumer Index, 52 percent of respondents consider price the most crucial purchase criterion. And with that, 42% percent will only buy from brands that align with their values and provide the gold standard of buyer experiences.

3. Cryptocurrencies Fall Down

Since Bitcoin hit an all-time high in November 2021, the value of the world’s most popular digital currency has fallen by about 70%. Unfortunately, this also rings true for other digital currencies, like Ethereum, and Dogecoin.

So, for online sellers, adopting cryptocurrency as a payment method is no longer relevant.

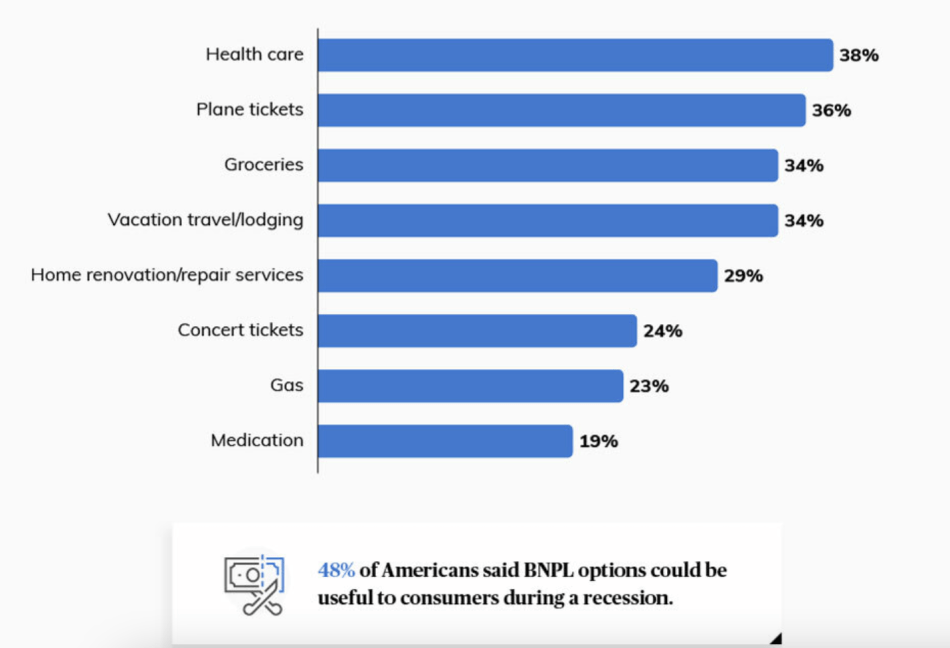

4. “Buy Now Pay Later” Method Gains Traction

Today, Buy Now Pay Later (or BNPL) is becoming a more prevalent, flexible, and transparent alternative to credit card loans. According to a recent survey from Credit Karma, nearly 60% of online shoppers confirm that inflation is driving them to use BNPL options.

Main Products and Services Purchased with BNPL during the Inflation.

5. Amazon Hikes FBA Inventory and Storage Fees

Effective April 28, 2022, an FBA fee surcharge of 5% is implemented on each unit sold, including products purchased before that date. As of now, it averages from a $0.15 to a $7.55 increase, depending on product size and category.

A Quick Overview of Amazon FBA Fees

2022 Amazon FBA Monthly Storage Fees:

Standard-size Items

January-September: $0.83 per cubic foot

October-December: $2.40 per cubic foot

Oversize Items

January-September: $0.53 per cubic foot

October-December: $1.20 per cubic foot

2022 Amazon FBA Dangerous Goods Fulfillment Fees:

- Small standard (6 oz or less to 16 oz) items have a per unit fee of $3.85 to $4.16.

- Costs for large standard items (6 oz or less to 20 lb) range from $4.29 to $6.57 + $0.30/lb above the first three pounds.

- Small oversize (70 lbs or less) costs $9.66 + $0.38/lb above the first pound.

- The medium oversize (150 lbs or less) fee is $13.56 + $0.44/lb above the first pound.

- Large oversize (150 lbs or less) costs $93.94 + $0.79/lb above the first 90 pounds.

- Special oversize (over 150 lbs) costs $170.74 + $0.79/lb above the first 90 pounds.

With fees also on the rise, online retailers struggle to keep costs down. One method is to redo their math to see how far they can discount the products and still make a profit.

6. Amazon’s Push For Lower Prices

With rising operational costs, Amazon sellers should adjust prices to protect their profits. However, the fierce competition among online merchants is now fueled by the customers’ demand for cheaper products.

In this context, raising prices doesn’t look like the relevant game plan for pushing conversions. Especially regarding how Amazon’s ranking algorithm works, favoring products with high sales volume, competitive prices, and a sufficient number of positive reviews.

If a seller raises their prices, Amazon search engine can move the position of products down the search results. This, in turn, can lead to less traffic and a decline in sales for the online merchants that increased their product prices compared to those who did not.

Additionally, many third-party sellers find it challenging to increase prices due to Amazon’s new price competitiveness policies. The eCommerce giant has consistently engaged in predatory pricing and is now selling products and services below cost to outgame competitors and expand its market share.

IV. Can Online Sellers Fight Inflation and Win?

Yes! And here’s how.

In this section, we’ve put together seven key strategies to help you protect your online store against the low profits that come with inflation.

1. Be Aware of Your Key Metrics

Data-driven decision-making is crucial for online sellers at each level of their eCommerce game, especially in the face of inflation.

With consistent KPI analytics, you access real-time business reports, allowing you to determine the areas that need improvement and optimize your store performance by:

- adjusting inventory

- maintaining profit margins

- managing advertising costs

- tracking target audience behavior

- targeting customers

- optimizing product lines

- pivoting marketing initiatives

- and more

Solution: To make their business reports more transparent and scalable, online sellers can use automated data management and analytics tools.

If you are using Amazon as one of your sales channels, a solution like Seller Labs Data Warehouse can help you create comprehensive, real-time business reports and develop a high-performance eCommerce strategy.

2. Increase Operational Efficiency

An operationally efficient eCommerce business provides a high-quality customer experience and shows high sales volume while requiring fewer efforts, time, and money to get there.

To improve the overall store efficiency in the face of inflation, online entrepreneurs can:

- automate inventory management to reduce the risk of manual errors

- streamline online orders’ fulfillment to provide delivery flexibility that resonates with the customers’ needs

- reassess operational costs according to the key metrics to manage their budgets intelligently

- use relevant marketing tools to double down on the customer engagement

Solution: Having a scalable and easily integrable shopping cart solution has always been essential for the operational efficiency of your online store. And, in these trying times, your business needs a powerful eCommerce platform more than ever.

Side note: At X-Cart, we gathered various automated no-code tools to accelerate your order fulfillment, simplify inventory management, streamline your delivery process, and maximize your marketing efforts.

Here are some of them:

ShipStation is web-based shipping, inventory, and customer marketing solution developed to simplify the order fulfillment, embracing the whole process from the moment the customer picks up products until they are delivered.

Expandly Multichannel Management Software is an all-in-one solution for managing your listings, inventory, orders, shipments, and accounting across various sales channels.

Mailchimp Integration with eCommerce Support is an email marketing automation platform where online sellers build their brands, showcase their products with style, recapture lost sales, and sell more stuff.

3. Improve Customer Engagement

In terms of eCommerce, customer engagement is the emotional connection that develops between a brand and its customers and encourages shoppers to purchase.

Given the competition among online sellers, trusted relationships with your target audience matter now more than ever.

To win customers and stand ahead of the pack, online entrepreneurs should:

- develop a strong social media presence by initiating virtual communication with your audience via influencer marketing or Tik Tok ads, to name a few

- solidify brand credibility by offering a gold standard of customer service

Solution: Online sellers can enhance customer loyalty and improve social media engagement via integrations with such marketing tools as HubSpot, Mailchimp, Facebook Chat, or Perfect Audience.

4. Adjust Your Prices

To avoid the rising costs, suppliers of raw materials raise their prices to the manufacturers, manufacturers raise their prices to the retailers, and retailers have no choice but to raise their prices and pass the costs onto customers. At first glance, hiking prices may be a tempting action plan, but in fact, todays’ shoppers are looking for cheaper products.

At that rate, your main challenge as an online seller is to optimize your product line without hurting your profits. Choose best-sellers to increase their product margins and use lower margin products as bonuses, benefits, or entry offers.

Solution: You can maintain your margins in your X-Cart store with the Cost Price module and create special offers and sales with Bundle Products add-on.

With Cost Price add-on, you can add the cost price to your products to automatically calculate the profit in the statistics report.

Bundle products add-on is designed to create wise bundles of products or/and services sold as a single package at a bargain price. Bundles work especially great when their components are available for sale separately but at a higher price.

5. Create a Seamless Customer Experience

When solidifying customer loyalty, you’d better look at the whole process holistically. Thus, the exceptional buyer experience is a combination of crucial components.

- Improved search experience

Why is search experience vital for conversions? The answer’s simple: If your customers are having trouble finding a product, navigating a particular section of your website, or loading search results, they are more likely to leave for another seller. The good news is that you can leverage your website’s search features to the full potential, no matter how many SKUs you have.

CloudSearch is a powerful search & navigation engine. It provides your customers with fast product search, a rich filtering experience, and real-time suggestions.

- Personalized checkout

Smooth and prompt checkout is a key to sales. With solutions like PayPal Checkout enabled in your online store, you can customize your checkout experience by offering multiple payment methods, including financing options.

Explore New Checkout Options

- Customer experience software

Customer experience management platforms, or CEM tools, help online sellers handle customer’s interactions with their brands. From fraud detection and inventory management to communication and analytics tools.

- Appealing website design

Here’s the fact: eCommerce websites should be unique in order to attract newcomers and turn them into regular buyers. This is where intuitive UX and UI design makes the case.

Side note: UI vs. UX

User interface (UI) is the point at which a person interacts with a computer or other electronic device. UI comprises the screen menus, icons, keyboard shortcuts, and cursor movements, to name a few.

User experience (UX) outlines how your customers feel about their interactions with your website.

UX and UI are both related to making the website session unique and turning a drop-in visitor to a recurring client.

Solution: Choose the tools and software that check all these boxes, and back your eCommerce business, while developing an efficient customer retention strategy.

6. Adopt Buy Now Pay Later

Having grown in the pandemic, BNPL keeps picking up steam as prices rise, influencing customers’ shopping habits.

As a PayPal study shows, 31% of the U.S. retailers offering its installment payments say they help increase sales. At the same time, other PayPal research finds that 80% of customers are more likely to purchase when they see a BNPL message while shopping online.

So, it looks like installment payments are a win-win deal for business owners and consumers alike, and Dave Tebaldi, Lead Product Manager at Groupon, is sure about it.

Solutions:

Within PayPal integration, online sellers can enable PayPal Checkout and accept debit and credit cards and Buy Now Pay Later payments.

Moreover, the PayPal Pay Later option offers some extra marketing features to inform online shoppers of an installment payment option early in their buying journey.

To give your customers more confidence to purchase, you can add more than one installment payment method to your checkout.

Affirm loans as a payment method can significantly increase your average order value and reduce cart abandonment. With Affirm, you can also include the details about the BNPL feature in your marketing content across the website.

7. Stay Ahead of Trends

As we know, forewarned is forearmed. So even if you don’t feel like you are struggling with your sales and brand now, it is better to stay in the loop and keep an eye on the ever-emerging eCommerce trends.

V. Key Takeaways

As long as online entrepreneurs face pressures caused by the economic downturn, the question of how hard the inflation can hit businesses is a topic of active debate.

Digesting the risks, business owners should focus on three priorities:

- Set prices strategically: As the consumers’ demand shifts toward services and experience, price dispersion and volatility can ensure selective opportunities for some eCommerce players.

- Avoid panic-driven decisions: Although most economists forecast that inflation will still be at about 4% or higher by the end of the year, we should bear in mind that the Federal Reserve’s efforts to lower inflation to its 2% target take time to act. Moreover, supply chains also need time to regain the elasticity of the pre-pandemic levels.

- Find a silver lining: The eCommerce store owners centered on resilience and controlled risk-taking stand a chance of relative outperformance. While keeping an eye on the current trends, they can create and seize strategic opportunities in bad times and sail their business ships in the right direction.

Thus, despite some top CEOs feeling pessimistic about keeping their companies afloat, eCommerce businesses’ solutions to combat inflation prove that it is still possible.

About the author