How Does PayPal Pay Later Work For Online Sellers? 7 Benefits of Adopting PayPal Loans

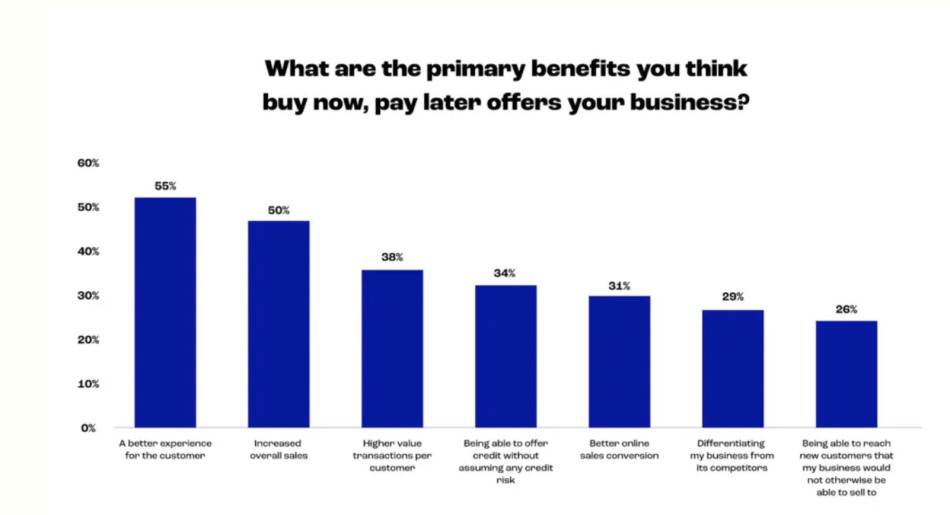

Whether you’re a well-established multi-channel retailer or a thriving local online merchant, adding a Buy Now, Pay Later (or BNPL) option can significantly level up your eCommerce game.

Going by the research conducted by the ZIP finance company, 91% of online sellers report improvements in at least one critical business metric after enabling Buy Now Pay Later, whether that’s revenue, Average Order Value (AOV), conversions, or expanded customer base.

At the same time, a PayPal study shows that 31% of U.S. retailers offering its ‘buy now, pay later‘ solutions say it helps increase sales.1

To help online sellers perfect their customers’ checkout experience and ramp up conversions, X-Cart widened its arsenal of payment methods by offering a new financing option included in PayPal integrations at no additional cost.

This article expands on the PayPal Pay Later plan and gives you five solid reasons to consider making PayPal installment payments a part of your eCommerce sales strategy.

So, let’s dive right in.

1 Netfluential study of 1000 U.S. PayPal SMB merchants selling directly to consumers through a website or e-commerce platform, commissioned by PayPal, August 2020.

What Is PayPal Pay Later?

PayPal Pay Later is a payment option provided by PayPal payment solution that offers your customers personal loans with a frictionless approval process.

To use PayPal Pay Later, online shoppers should create a PayPal account or use an existing one in good standing. The Pay Later option is also available to consumers via PayPal App.

PayPal Pay Later offers two payment plans:

| Pay in 4 | Pay Monthly |

| 4 bi-weekly interest-free payments on purchases of $30 to $1500 | 6, 12, or 24 monthly payments for purchases of $199 to $10,000 |

| Short-term installment option | Medium to long-term installment options |

| 0% APR | APRs from 9.99% to 29.99% |

| No origination fees of late fees | No origination fees of late fees |

| Repay using a debit card, credit card, or confirmed bank account | Repay using a debit card or confirmed bank account |

| Automatic repayments are set up at time of purchase | Automatic payments are an option to set up at time of purchase |

| Seller protection and purchase protection are included | Seller protection and purchase protection are included |

| Included with PayPal Checkout at no additional cost | Included with PayPal Checkout at no additional cost |

- Pay in 4 is a short-term loan with no late fees that allows customers to split the purchase into four interest-free payments, while online sellers get paid right away.2 Pay in 4 works within all the U.S. states, excluding Missouri, Nevada, New Mexico, North Dakota, Rhode Island, South Dakota, Wisconsin or any U.S. territories.

- Pay Monthly is a special financing offer for larger purchases. With this newly-launched PayPal payment option, customers can purchase up to $10,000 and spread the costs over 6, 12, or 24 months. Similar to Pay in 4, online shoppers pay over time, while merchants get the full amount upfront.3

Important Note: Online merchants can activate the PayPal Pay Later option from their online stores with no hassle and at no additional cost if they have PayPal Checkout integrated into their eCommerce websites.

With a BNPL feature enabled at their online stores, business owners enjoy plenty of opportunities to beat the competition and thrive across their markets.

We’ve put together seven of the most significant benefits of adding PayPal Pay Later to your checkout.

2 About Pay in 4: Loans to California residents are made or arranged pursuant to a California Financing Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457. Rhode Island Small Loan Lender Licensee.

3 Pay Monthly is available Q1 2022. Pay Monthly is subject to consumer credit approval. 9.99-29.99% APR based on the customer’s creditworthiness. PayPal, Inc.: RI Loan Broker Licensee. The lender for Pay Monthly is WebBank.

How Your Online Store Will Benefit From PayPal Pay Later

1. Increased Overall Sales

The biggest perk that online sellers get with PayPal Pay Later is removing price as a barrier.

As a result, online shoppers feel more comfortable moving forward with a purchase, which helps online sellers to:

- Ramp up conversion rates

- Foster unplanned purchases

- Generate repeat purchasing

- Increase average order values

- Reduce cart abandonment

When online merchants offer flexible PayPal loans at their online stores’ checkouts, they improve their (AOV) average order value by encouraging their customers to buy more often and in greater amounts.

Thus, an enlarged number of high-ticket sales and an expanded customer base can boost the overall store performance.

2. Enhanced Customer Engagement

Whereas PayPal Pay Later plugs seamlessly into the X-Cart eCommerce platform, it brings out some extra marketing features to engage with your target audience.

Online retailers can add dynamic messaging on product pages next to price points, and highlight Buy Now Pay Later options early in the customer’s buying journey.

Why is it important?

According to PayPal, 80% of shoppers confirmed that seeing a buy now, pay later message while shopping online gives them the ability to spend more.4

With this feature, you don’t just offer your customers transparent and honest financing options, but you also show them that you put their needs first. Feeling safe and valued, online shoppers keep coming back, which results in your Customer Lifetime Value (CLF) increase.

4 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39 (among BNPL Users, n= 357).

3. One-Size-Fits-All Integration

As a highly customizable and configurable shopping cart solution, X-Cart provides an array of no-code tools and integrations to help your eCommerce business expand and thrive.

Side note: The Pay in 4 and Pay Monthly are included in the PayPal Checkout and can be activated directly from your X-Cart store with no coding skills required. So you will be able to start offering PayPal Later payments to your customers right off.

With PayPal enabled in their X-Cart stores, online merchants have access to a single, unified payment integration that streamlines their payment processing and allows for:

- automated online invoicing

- chargeback protection

- credit and debit card processing without leaving your store’s checkout page

- installment payments option

- order management and transaction history reports

- payments via PayPal guest checkout, and more

Ready to Integrate PayPal Into Your X-Cart Store?

4. Contribution to Seller’s Credibility

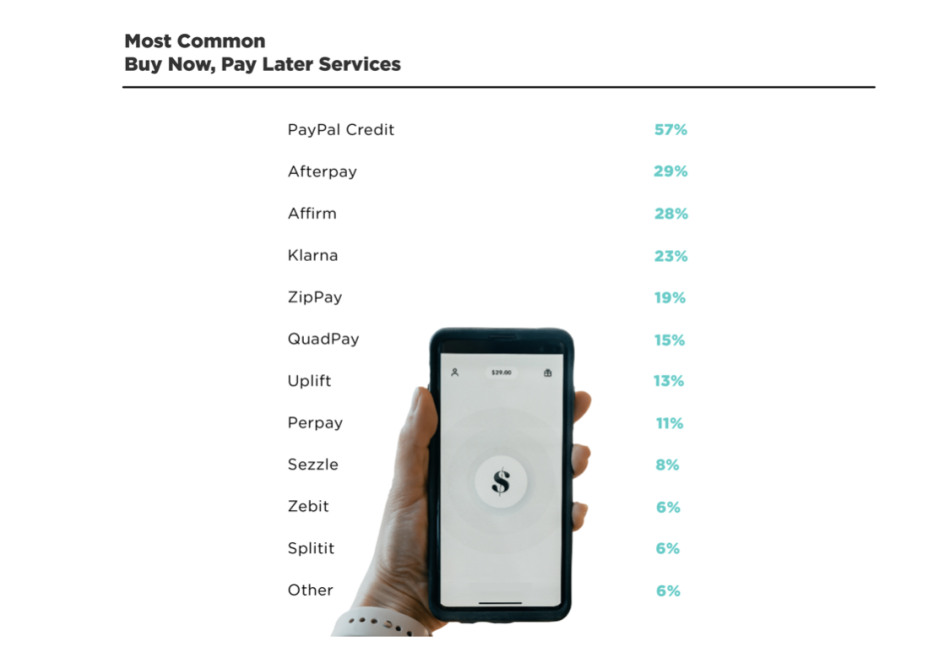

Going by C+R Research, PayPal installment payments retain the #1 spot among the most commonly used Buy Now Pay Later companies, such as Klarna, Afterpay, or Affirm, to name a few.

By adopting one of the most trusted BNPL providers5, you can take advantage of PayPal’s popularity and reputation, boost your credibility as a seller, and build long-term trusted relationships with your buyers.

5 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

5. Keeping Up With the Consumers’ Needs

Today American consumers face soaring inflation, coupled with the economic backlash from the ongoing COVID-19 pandemic.

Under these challenging circumstances, more and more online shoppers turn to installment payments to cope with rising prices and supply chain uncertainty.

As an online retailer, you should keep a sharp eye on your buyers’ shopping behavior and preferences to offer a personalized customer experience. With a financing solution, like PayPal Pay Later, you can hit that spot.

6. Broader Target Market

Given that PayPal is empowering more than 400 million consumers and millions of online stores in more than 200 markets, we can say with confidence that it has built an impressively large customer-merchant ecosystem.

By joining their network, you can significantly expand your customer base and win a competitive edge over those merchants that don’t offer installment payments as an option.

On top of that, PayPal Pay Later enables online merchants to expand their target audience by including younger customers, wary of traditional credit card approaches.

As noted by Insider Intelligence, the overall bump in the BNPL usage is headed by Millenial and Gen Z shoppers, who tilt towards more flexible point-of-sale financing options that allow them to pay off purchases in a more manageable way.

While sellers are looking for new payment trends resonating with younger shoppers, PayPal financing options hold the key to capturing and retaining these customers long-term.

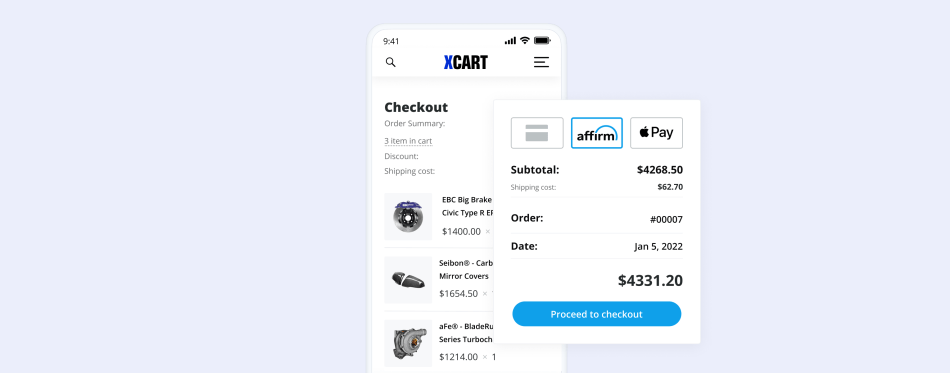

7. A Bonus Perk For Automotive Aftermarket Stores

With X-Cart offering a full-fledged Automotive eCommerce Solution and PayPal Later activated in your online store, you can take your online auto parts shop to the next level.

If you are looking for an authoritative and independent opinion to guide you on this topic, we have one.

Dave Tebaldi, Lead Product Manager at Groupon and an avid auto enthusiast, is sure that BNPL is a handy feature for online auto store owners, even if they don’t sell big-ticket items.

On top of the personalized checkout experience, auto parts retailers with X-Cart stores enjoy extra opportunities to make their auto website even more trustworthy.

What does X-Cart eCommerce platform offer to auto parts store owners?

- Smart multi-facet search and filtering options

- Relevant sales channels

- Detailed and specific catalogs

- Best-in-class payment integrations, including Affirm installment payments

- High volume SKUs

- Complex search needs

- Adaptive and responsive website design

Looking for a High-Quality eCommerce Platform to Sell Your Car Parts Online?

FAQs

X-Cart and PayPal offer a simple integration for their merchants to quickly and easily provide BNPL solutions to their customers at no extra cost.

PayPal Pay in 4 makes a soft credit check, which will appear on the customer’s credit report but will not affect their credit score. As for Pay Monthly, it is subject to consumer credit approval and makes an inquiry on the borrowers’ credit reports.

There’s no extra charge for online sellers; they just pay their regular PayPal transaction fee.

Yes. Since 2019 PayPal reports to at least one of the three credit bureaus (usually Experian).

Bottomline

Due to the current economic struggles doubled by the post-pandemic challenges, online sellers have to deal with the decrease in the buyers’ purchasing power, which urges them to look for more ways to retain customers.

Whereas digital financing options are getting more and more traction among online shoppers, adding PayPal Pay Later to your checkout is a clear win.

With PayPal Pay Later, X-Cart store owners get flexible checkout, dynamic marketing capabilities, and flawless implementation at no additional cost.

PayPal’s financing solution will back you while developing a winning customer acquisition strategy that can boost sales and improve the overall online store performance.

Ready to Offer BNPL in Your Online Store?

Activate PayPal Pay LaterAbout the author