Choosing a Proper Tax Compliance Software for Your eCommerce Platform

To paraphrase Benjamin Franklin; “nothing is certain except for death and taxes”. Over 200 years later, this axiom still rings true.

As an online seller, you face numerous challenges in today’s fractious tax landscape. Along with the sales and use tax rules, the Wayfair case has also affected income taxing, bringing new challenges for eCommerce businesses.

Michael Flemming, the President and Founder of Sales Tax & More and an authoritative speaker at Seller Labs Resonate Conference, is sure that income tax will be the next big battle for online sellers.

Against this backdrop, more and more online entrepreneurs tend to turn to expert opinion and professional assistance to handle all the tedium of tax filing. And this is where eCommerce sales tax solutions come into the picture.

This article defines what a tax app is and highlights the benefits of empowering your eCommerce store with a proper sales tax compliance tool. As a bonus, we are offering a quick overview of the main features of the top 5 sales tax automation solutions, some of them with free trials to test the waters.

Let’s get started one step at a time.

What is Sales Tax Automation Software?

Sales tax software is the online program or platform to integrate with your Shopping Cart solution and apply to invoices at the checkout.

In sum, sales tax tools are designed for online business owners to make their lives easier and to take the burden of researching rates and filing forms off of their plates. With automation, sales tax apps should also assist you with tax compliance.

A full-featured eCommerce sales tax software should:

- track sales tax, VAT, or other rates and rules relevant to online sellers’ products or services

- manage tax exemption certificates

- automatically update sales tax rates and rules to ensure tax compliance

- connect with an online seller’s eCommerce platform to integrate, store, and apply the correct rates where necessary

- file tax returns and manage remittances for all jurisdictions

Along with the functionality, online business owners generally pay special attention to tax apps’ pricing, usability, and client support.

Why Do You Need Sales Tax Automation?

Looking back at the very beginning of your business journey, what was the first question you asked yourself while choosing an eCommerce platform? I bet you wondered if your Shopping Cart platform would be able to support your online business as it grows and matures.

As a newly-fledged online entrepreneur, you may not need a no-code tool connected to your online store to handle taxes. Still, it’s only a matter of time: as your customer base expands, affecting your transaction volume, tax rate calculations grow more complicated.

This is when you start looking for a robust and easily integrable sales tax app to ensure you are handling tax processes efficiently and correctly.

Side note: As a highly configurable and customizable eCommerce solution, X-Cart offers an extensive array of add-ons including a couple of free integrations with reputable tax management software:

Avalara’s AvaTax Sales Tax Automation add-on automatically provides cloud-based sales tax calculation with comprehensive, up-to-date tax rates pushed to your shopping cart or invoicing system.

TaxJar Sales Tax Automation add-on helps online sellers put their sales tax on autopilot by automating sales tax returns and reports.

TaxCloud add-on is designed for online merchants of any size to calculate the sales tax due on each transaction and prepare monthly reports.

Sales Tax add-on helps to configure rules for calculating sales tax on orders in your shop if you’re running an online business in the USA and Canada.

Tax Exempt add-on helps to define tax-exempt customers and products in your online store.

Value Added Tax / Goods and Services Tax add-on enables you to configure the Value Added Tax in your store if you sell in Europe (VAT), Australia (GST), or other countries with similar tax systems.

One more problem with sales tax rates and rules is that they’re dynamic, especially when it comes to digital sales taxation. Whereas eCommerce is getting momentum, the US tax jurisdictions keep adding new tax obligations for online transactions.

In order to avoid running into trouble with tax calculations, collections, and remittances, as well as catch up with the rapidly-changing economic nexus laws, online sellers go for automated sales tax management.

All that said, we can name at least five advantages of having a proper sales tax software solution in your corner.

5 Benefits of Choosing Sales Tax Automation

- Time-saving: hours of manual work can be completed in minutes with automated sales tax rate calculations.

- Compliance: timely updates of the latest rules for different jurisdictions.

- Meeting tax payment deadlines: an alert system helps to keep track of deadlines from the dashboard and schedule returns to file them on time.

- Making your online business audit-ready: while tracking transactions and filing returns, tax management software creates an overview of compliance to use these tax data for the tax audit.

- Minimizing the risk of tax reporting errors: automated processes exclude the possibility of human error.

A Bonus Pack: 5 Popular Sales Tax Solutions

Given that looking for proper sales tax automation software on your own can be quite challenging, we’ve tried to take the research effort off of your plate.

Here’s a quick overview of the 5 popular sales tax apps with their main pros & cons based on their customers’ reviews on GetApp.

| TaxJar | Avalara AvaTax | Vertex | Thomson Reuters | CloudTax | |

| API | ✔ | ✔ | ✔ | ❌ | ✔ |

| Address Validation | ✔ | ✔ | ✔ | ✔ | ✔ |

| Audit Trail | ✔ | ✔ | ✔ | ❌ | ✔ |

| Compliance Management | ✔ | ✔ | ✔ | ❌ | ✔ |

| Data Import/Export | ✔ | ✔ | ✔ | ❌ | ✔ |

| Exemption Management | ✔ | ✔ | ✔ | ✔ | ✔ |

| Free trial | ✔ | ❌ | ❌ | ✔ | ✔ |

| Invoice Management | ❌ | ✔ | ✔ | ❌ | ❌ |

| Multi-currency | ❌ | ✔ | ✔ | ✔ | ❌ |

| Pricing | starts from $19 per month | starts from $25 per month | available upon request | available upon request | starts from $10 per month |

| Reporting & Statistics | ✔ | ✔ | ✔ | ❌ | ✔ |

| Sales Tax Management | ✔ | ✔ | ✔ | ✔ | ✔ |

| Support | ✔ | ✔ | ✔ | ✔ | ✔ |

| Returns Management | ✔ | ✔ | ✔ | ✔ | ✔ |

| Tax Calculation and Filing | ✔ | ✔ | ✔ | ✔ | ✔ |

| Taxability Verification | ✔ | ✔ | ✔ | ✔ | ✔ |

| Third-party integrations | ✔ | ✔ | ✔ | ✔ | ✔ |

| Transaction Tracking | ✔ | ✔ | ✔ | ✔ | ✔ |

| Value Added Tax (VAT) | ✔ | ✔ | ✔ | ✔ | ✔ |

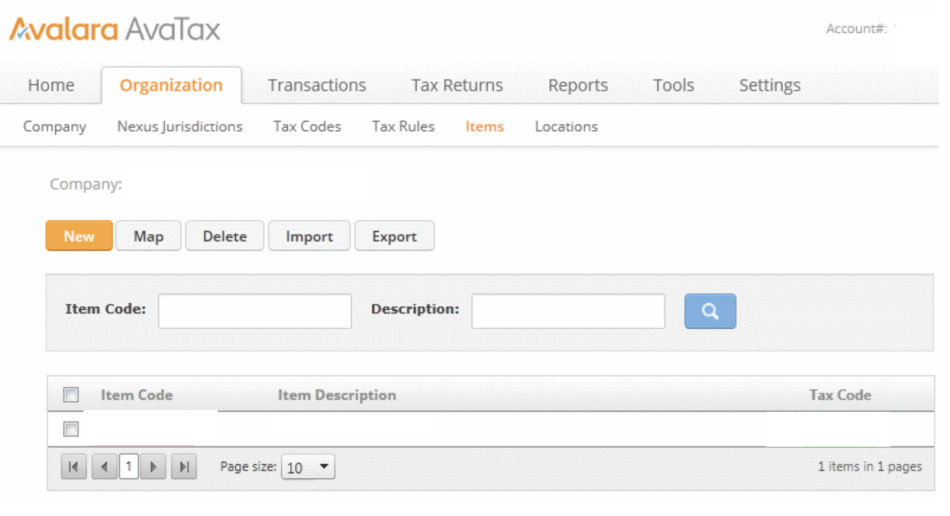

Avalara Avatax

Avalara is the leading tax app that helps eCommerce businesses get their tax compliance right. With solutions for various transaction taxes, including sales and use tax, and VAT, the Avalara tax compliance tool helps online sellers to calculate taxes, file and remit returns, and comply with sales tax management requirements.

Pros:

? The ease of use

? Variety of services offered

? The opportunity to drill down into an invoice and see how the tax was calculated

Cons:

? According to multiple reviews on GetApp, the Avalara AvaTax doesn’t seem to work with Quickbooks correctly

? The solution can be expensive for small businesses

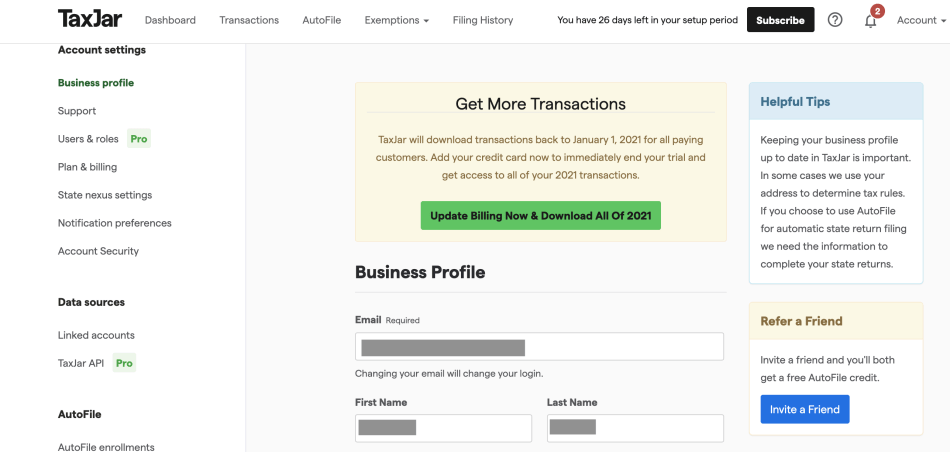

TaxJar

Going by the number of ratings on G2, the TaxJar cloud-based tax compliance platform is a high performer. Providing award-winning tax compliance services, from calculations and nexus tracking to reporting and filing; TaxJar has you covered.

Pros:

? Multiple integrations

? Real-time notifications

? Clear and user-friendly dashboard

Cons:

? Some customers find TaxJar support inefficient: phone support goes to voicemail 99% of the time

? The free version does not give you enough options

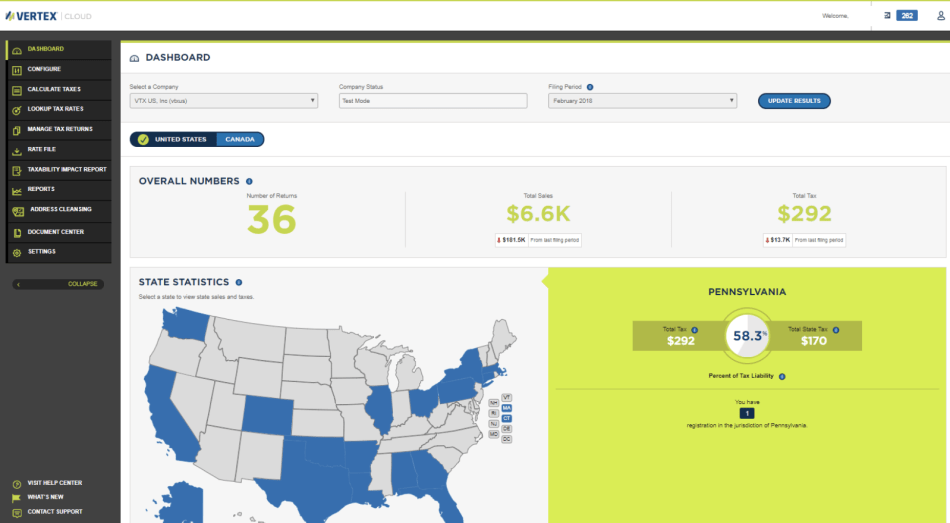

Vertex Cloud Indirect Tax

With over forty years of experience in tax compliance and over 4000 customers in 130 different countries Vertex tax software offers flexible and configurable solutions to handle your sales tax burden.

Pros:

? Accuracy of calculations and the ability to process significant amounts of data quickly

? Criteria for verifying product taxability in each state

? The cloud portal is easy to navigate and clear to understand

Cons:

? Updates and testing are made without notice which can result in downtime for your eCommerce App

? No free trial

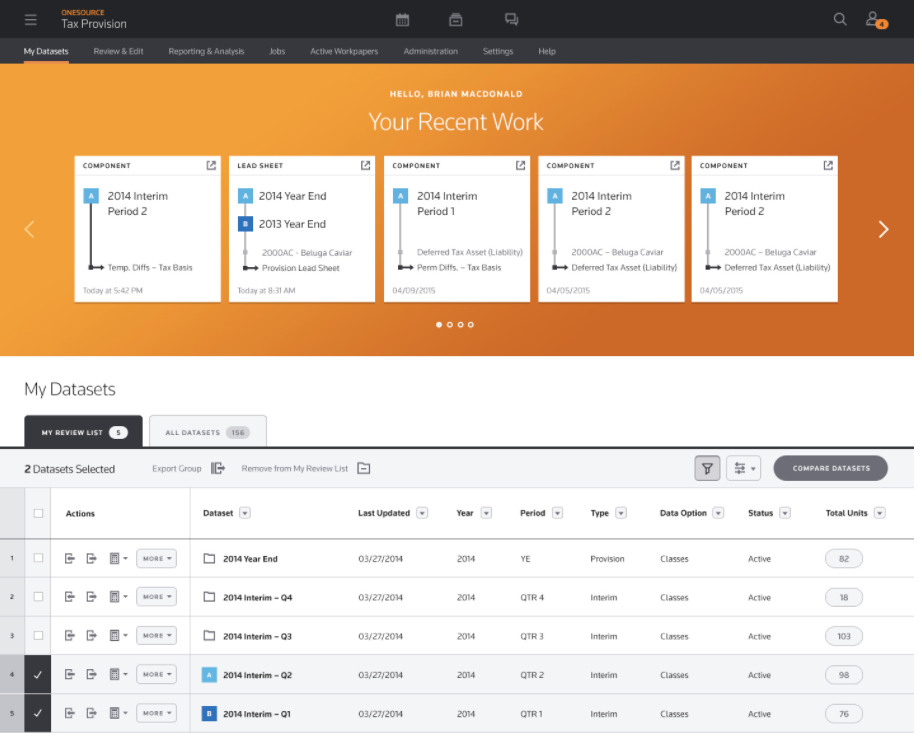

Thomson Reuters ONESOURCE Indirect Tax

ONESOURCE Indirect Tax by Thomson Reuters offers four different types of products: Determination, Indirect Compliance, Fast Sales Tax, and Certificate Manager.

These platforms boast a variety of features such as sales and tax analytics, compliance, up-to-date VAT tools, and certificate validation, to name a few.

Pros:

? The cloud-based free trial includes support, service, training, and some video tutorials

? Layout with Intuitive tree format

? Well-maintained sales and use tax databases which make compliance in 100+ state and local jurisdictions manageable

Cons:

? It may be challenging to reach out to the right support team to solve your query

? Sometimes it is difficult to make changes or edit fields

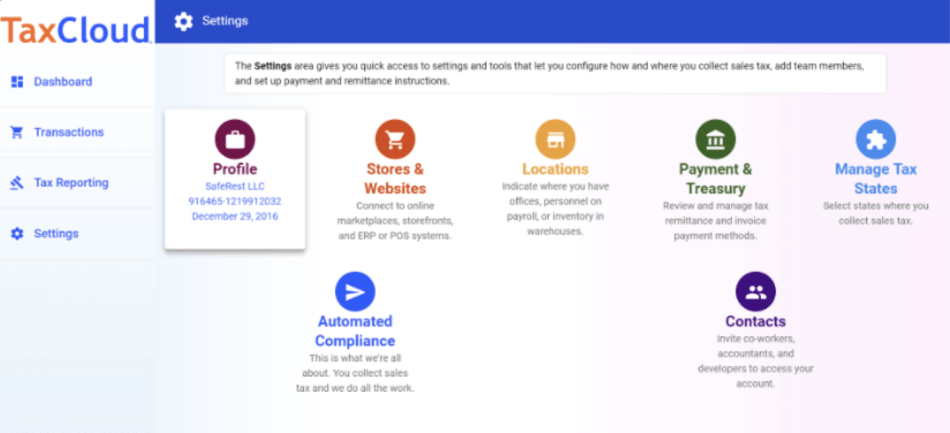

TaxCloud

TaxCloud helps to determine the applicable sales tax rate based on product or service, collects sales tax at the point of transaction, and manages tax returns.

Side Note: As of January 2021, TaxCloud no longer offers fully free services in their member states.

Pros:

? TaxCloud is certified to meet the requirements of the Streamlined Sales and Use Tax Agreement (SSUTA)

? A robust sales tax reporting tool

? A fair number of integrations where tax setup is turnkey

Cons:

? A lot of bad reviews on customer support

? No integration with eBay

The Bottomline

Choosing to go with the sales tax solution, reduce the time and effort invested into your tax compliance management – and yet stay within your budget!- is hardly a decision that you’d make lightly.

Regardless of their business size, online sellers have a lot of factors to weigh early in the game to avoid tax-filing hurdles. Choosing the eCommerce platform, which would be easily compatible with third-party integrations, is one of the first things to consider.

As a standalone online store builder with plenty of reliable partners, X-Cart covers all the bases of your online business. In addition, we can help you out with a unique solution, if you didn’t find the integration that suits your business needs the best.

Tell us about your project and learn how to simplify your store management with X-Cart’s versatile functionality.

Need a customized solution?

Yes!About the author